Hey parents, aren’t you sometimes tired of constantly hearing your kids pestering you of the whereabouts of their HongBao money?

We’ve been there and heard tons of complaints from other parents too. But what exactly are kids complaining about and how confident are you in answering these complaints?

From our experience running the recent HongBao workshops, all children are actually aware of where their HongBao money is. It could be in the bank, their piggy bank, in the drawers, anywhere. Despite this, they don’t have much excitement or desire towards the money because in the end, it’ll still go into the bank, and they are not allowed to touch or use the money.

However, if you zoom into the root cause of all these complaints, perhaps, you can better understand why your children are questioning where their HongBao money is – they want to spend their Hong Bao money!

Giving and receiving red packets has been a prevalent tradition amongst various generations and some may be reluctant or find it difficult to transition into e-HongBaos. Many reasons contribute to this reluctance, and several reasons could include the lack of internet savviness and the belief that receiving physical red packets passes down good luck and protection against evil spirits.

The adoption of e-payments significantly grew this past year as it is more convenient than cash. Though many may disagree with switching to e-HongBaos to maintain the Chinese tradition, it is inevitable that the world is going cashless.

The coming Lunar New Year offers an opportunity for us to build on this momentum, to spread the benefits of e-gifting, and to forge new traditions with our families and friends. Therefore, it is of great importance and urgency for parents to start equipping children with money management skills in a cashless society.

Why so? Four reasons!

Firstly, it’ll resolve the issue surrounding kids’ complaints about parents “confiscating” or “pocketing” their HongBao money.

Secondly, this is a great opportunity to teach your children about visible and invisible money. Not seeing actual money exchanged for an item/service makes it hard for children to grasp the concept or value of Money. This may breed the thinking of “invisible” money as an abstract and unlimited resource, leading to a snowball of poor financial decisions and concepts in the future.

Thirdly, there is an increasing number of youths who are bankrupt due to the lack of financial literacy and education in schools and at home. We don’t want our children to end up there, so as parents, we should make haste, and start cultivating proper money habits in our children from a young age.

Lastly, we don’t want our kids to be FOMO when it comes to opportunities for their money to grow, do we? If you understand the concept of compound interest, you’ll know how important time is for money to grow. Hence, the urgency in teaching our kids about money!

It is in our human nature to learn best by copying, even more so in children. Thus, your children’s money management skills and habits will be largely influenced by what you do. This means that what and choose to do with your children’s HongBaos will inherently affect the way your children manage their money later in life.

With that said, we should seize every moment to shape our children’s monetary habits and empower them in making wiser financial decisions. Children at the age of 5 can perform and understand basic math, making it the ideal time to start teaching them about money concepts.

Money Jars System

Money Jars System

Some conversation starters about money concepts such as saving can begin when your children are requesting kiddy rides or presents whenever you are at the mall. In addition, you can make small agreements with them on their allowance before they enter primary school and use our Money Jars System to help gamify the money-saving routine for your children.

As Chinese New Year is around the corner, it’ll come as no surprise if you receive some e-HongBaos on behalf of your children. Here are some ways in which you can use this as an opportunity to teach your children about “invisible” money.

- Wrap the amounts you received in e-HongBaos into physical HongBaos of different wrappers where possible.

- Only release the physical HongBao to your children on the day where they pay their respects to the person who gave them the e-HongBao over zoom or physically.

- Let your children collate these red packets, count them at the end of the day and compare them with their other relatives or children.

- At the end of the Chinese New Year season, count the money together with them.

After you collate all their HongBao money, how about opening a savings and investment account for your children instead?

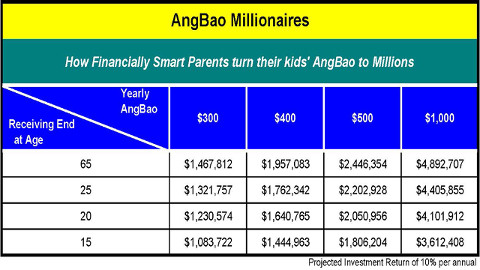

Just by looking at the table, you’ll see that with just $300 per year and a projected investment return of 10% each year, your child will be able to turn their HongBao money into a million without much effort through the power of compounding.

Of course, you may ask about the 10% annual returns because a bank account definitely does not have such an attractive interest rate for any savings plan. Hence, if you would like to learn more about growing your money and how to impart these skills to your children, we would recommend checking out our Financial Parenting Workshops to equip you with the necessary skills and knowledge to grow your wealth as well as grow your children’s HongBao Money.

Now that you know our secret, don’t just stuff your children’s HongBao money into a Milo can or under their bed anymore!

By Ernest Tan, Jopez Academy.

Ernest Tan is the founder of Jopez Academy and has over 26 years of experience as a Certified Financial Planner, Master Money Coach, Lead Trainer & Facilitator. He is the author of Raising Financially Savvy Kids and Creator of Money Junior Board Game.

His powerful, easy-to-use, engaging & fun financial curriculums have made it easier for people to acquire new financial and wealth habits, attitudes to achieve their dreams faster regardless of their current financial situation. He has been featured on Channel News Asia, The Sunday Times, 938LIVE, Capital 958FM and LiteFM.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.