The concept of money is a means or medium of exchange. In ancient times, people use stones and seashells. Today, money transactions are becoming more and more virtual, with many cashless options available.

- Will our children be able to make connections between virtual money and real money in a cashless society?

- How can we teach them about the value of money?

Ernest Tan, Founder and Director of Jopez Academy and author of ‘Raising Financially Savvy Kids’ shares 10 savvy tips.

#1 Take An Active Role

Parents need to step up to play an active role in making kids interested to learn about money. The fundamentals of teaching money are the same as teaching any topic.

Think IVF – interactive, visual and fun.

#2 Make It Visual

Use the tangible to teach the intangible. Set up the Money Jar system.

You will need three jars for this.

Categorise them into ‘Spend’, ‘Save’ and ‘Share’. Decorate the jars and personalise them. Get your kids involved and explain to them what the jars are for.

Always give your child’s allowance in loose change so they know how to portion it from young.

The proportion should be: 20% – Save Jar, 70% – Spend Jar, 10% – Share Jar.

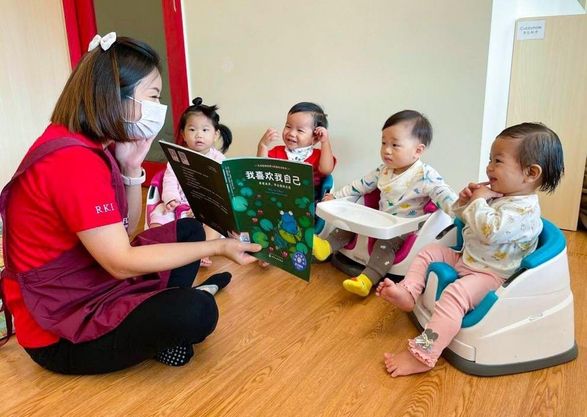

#3 When Is The Best Age To Start?

You can start even when your child is a toddler!

Encourage them to drop coins into a jar as a motor skill activity. Even though they may not understand their actions, you are creating an imprint through the physical act of dropping coins into their future Money Jars.

You can formally introduce the Money Jar System when your child is able to understand the concept of counting, and simple addition and subtraction.

Next, give them a small allowance each week to portion into their Money Jars.

#4 Make It Fun

Role-play with your child.

Create a ‘bank corner’ in your child’s room, where mummy or daddy is the ‘banker’. Give them a ‘bank book’ (this can be a simple notebook) and help your child record any transactions made for each jar.

When they are old enough, encourage them to write on their own. This promotes literacy skills and exposes them to financial terms e.g. deposit, save, spend, invest and so forth.

#5 Ways To Encourage Children To Save

Encourage them to set goals for each jar e.g. $5 in the Save Jar by the end of March.

To encourage children to save more, why not top up their savings amount with ‘interest’? E.g. for every $10 your child saves in the Save Jar, the bank (aka mummy or daddy) can top up another 20 cents into their Save Jar.

Or if you think your child has been saving well and disciplined with his spending, reward them by declaring a special ‘Bank Anniversary Day’ or ‘Birthday Promotion’. E.g. for every $5 in the Save Jar, your child gets an extra 10 cents.

During Christmas season, you can create your own family ‘Charity Drive’ day where you donate pre-loved items at home. E.g. for every pre-loved toy your child donates, they stand to receive a new toy from the ‘bank’ of a similar value.

#6 Make It Interactive

Bring your child along to the bank or show them the process behind any online money transactions.

When you’re showing them an online transaction, get them to make the final transaction by clicking or tapping on the ‘confirm’ or ‘submit’ button.

When you’re creating a joint-account, bring them with you to the bank. You may even encourage them to speak with the bank teller on what they would like to do i.e. start a joint-account with mummy or daddy.

When you’re depositing their Chinese New Year ang pow money, bring them with you to the ATM machine. Get them to slot in their own money into the feeder.

Children learn more with your presence and when there is something or someone to interact with.

#7 Lead By Example

To encourage children to have a habit of giving back, you can adopt a beneficiary together as a family and pledge to donate a certain amount of money monthly, quarterly or bi-annually, annually.

Bring them along for food donation drives or spend a day with children with special needs or children from less privileged backgrounds.

Encourage them by doing it yourself. When you’ve made a donation, tell them about it and why you did it.

Get inspiration from the government policies (i.e. Tax rebates, $1-$1 matching) and how the government encourages us to save and give. Adopt these ideas for your kids to spur them to save.

Every year, print out their account statement and show them how much money they have accumulated over time. Just like adults, children love to see their accounts grow.

#8 ‘Graduating’ To A New Spend Jar

If the Primary school your child is enrolled in adopts a cashless system, explain to them that money in their physical Spend Jar will be transferred to another ‘Spend Jar’, which is their smart watch or EZ link card.

This device (be it a card or watch) which holds ‘invisible’ money now becomes a new ‘Spend Jar’ for your child.

Your role is to play the middle person or banker, to ‘transfer’ the physical cash from your child’s Spend Jar into ‘invisible’ cash, which is transferred into your child’s smart watch or card.

#9 Making The Transition

It’s important to show your child the entire process from start to finish.

First, ask your child to take out the money from his Physical Spend Jar and pass it to you.

Once you (the ‘banker’) have kept their money, log on to your bank account and show them how the money is being transferred from your account into their device.

By doing this, the connection between the physical cash and invisible cash is more vivid, as they are able to see the process behind the transaction. They know exactly where the money goes and how it is being transferred.

Many parents usually protest at this point and say, “But I don’t want my child to see my full earnings or savings in my account!”

Create a new account for this purpose of transferring money as ‘Mummy/Daddy’ banker.

Explain to them how money ends up in this account, e.g. this money comes from your monthly salary.

Portion your wealth, and practice the money jar system yourself.

#10 Physical Presence Is Still Important

Many parents ask me, “During the transition from physical to virtual, should the physical Money Jars still be there?”

Yes, all three jars should still be physically present, until children are old enough to have their own bank accounts. This is to establish a strong co-relation between the physical and digital Spend Jar.

If your child wants to transfer all his money in his physical Spend Jar into his new digital Spend Jar (smart device), gently tell him or her about the consequences of losing the device, e.g. if they lose the device, they will also lose all the money in it.

This will make them take care of their items and think twice about putting all their eggs in one basket.

Summary:

- Take an active role

- Start young

- Use the Money Jar System

- Make it IVF – Interactive, Visual and Fun

- Use incentives to encourage children to save and give back

- Involve them and show them how transactions are made

This is the fifth and final part of our E-book series: How To Raise A Money-Smart Child. You can download Part 5 of this E-book here.

Leave a Comment: