When do you open a bank account for your child? Which bank should you go for?

For some, this starts as early as the day your child is born, beginning with the CDA (Baby Bonus) account either with OCBC or Standard Chartered. For others, it could be after your child’s first Lunar New Year, with their first collection of ang pows (red packets).

⇒ Related Read: How To Use Ang Pow Money To Teach Children The Value of Money

There are benefits of starting an account for your child.

1. It teaches and encourages them to develop a healthy lifestyle of saving money.

2. As your child gets older, it’s a way for them to get started on money management, e.g. managing their weekly school allowance, or saving up to buy something they want.

3. For financial or investment-savvy parents, it might be a way to begin their children on a path towards financial returns, earned from placing their money in investment plans, geared to provide returns or financial security for the future, e.g. university education, when they get married, or when they buy their first home.

There are lucrative and profitable ways to invest money or earn interest for your children. Speak to a financial planner to learn which are the best investment plans for your family.

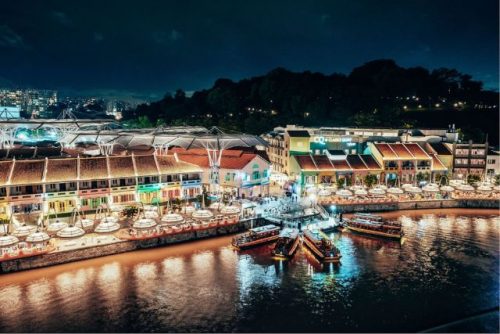

Different Banks with Children Accounts in Singapore

There are many banks in Singapore, and it is impossible to showcase or consider them all, but these 6 banks (3 local, 3 foreign) should provide a basic summary of what the options might be for you and your child.

ePOSBkids

- Eligibility – up to 15 years

- Joint-alternate account (either joint, or parent or child singly)

- No minimum deposit or fall-below fee until 21

- No coin deposit fee until 16 (good for piggy bank savings)

- ATM card for joint account

- More than 100 branches, including 15 weekday evening branches

- Freebies – free 6-month Popular card (age 7-15), $1 gift deposit, limited SG50 smiley coin bank (this year)

- From 13 July 15, POSB will be offering parents an interest rate of 2% p.a. for the entire duration on their Child Development Accounts (CDAs)

OCBC Mighty Savers

- Eligibility – 16 and below (under 5, joint account)

- Young savers (sole/joint account), or passbook/statement/school savings (trust account)

- No minimum deposit, minimum $1 balance

- 55 branches, including 16 full-service on Sundays 11am-7pm, priority queue for kids

- Freebies – wrist band, stationary set, sling bag

UOB Junior Savers

- Fall-below fee – $2 if below $500

- Free monthly funds transfer from parent’s account (UOB or other banks)

- ATM card (NETS, PLUS)

- 68 branches

- Free insurance up to 100% of deposit (min. $3000 in account)

Maybank Youngstarz

- Eligibility – below 16

- Trust account

- Minimum deposit $10

- 22 branches

- Highest interest 0.1875-0.375%

- Personal accident and/or HFMD insurance (min. $2000 in account)

Standard Chartered e$aver Kids

- Eligibility – below 21

- Trust account

- No minimum deposit (min. monthly $50 transfer), no fall-below fee

- $5 per cash withdrawal

- 19 branches

- 0.1-0.25% interest

Citibank Junior Savings

- Eligibility – below 18

- Trust account

- No minimum deposit, no fall-below fee

- ATM (above 15 years)

- 22 branches

- If it’s interest rates that you are keen on, then either the Maybank or Standard Chartered ones would be best, if you are comfortable with less branches available islandwide.

Worth mentioning are the UOB and Maybank accounts, which provide free insurance, personal accident and even HFMD insurance, with a minimum balance of between S$2000-3000.

Do note that what is mentioned are only some highlights or stand-out points for each bank. Most are similar in features and benefits, and it really depends on what your reasons or expectations are for setting up your child’s bank account.

Making financial decisions for your child might be stressful or carefree, depending on our approach and factors to consider. Hopefully, with this snapshot of current bank accounts for children, you will be able to make a decision according to your family and child’s financial needs.

By Som Yew Ya

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Leave a Comment: