What do you do with your child’s ang pow money? Do you keep them or ‘re-use’ them in your own ang pow pile? Or do you deposit them directly into your child’s bank account?

Chinese New Year is a great opportunity to teach children about money, says Ernest Tan, Director of Jopez Academy.

“The CNY season is a great teachable moment. Children get a financial windfall from their ang pow collection. Why not make use of this chance to teach them how to handle money responsibly?”

Ernest, who is a self-made millionaire, started Jopez Academy to impart financial knowledge to parents who wish to achieve financial success and instil good money habits in their children.

He shares with TNAP how parents can make use of ang pow money to educate children about being financially savvy.

Tip #1: To keep or not to keep?

Kids should understand whether it is a privilege or an entitlement for them to be able to keep their ang pow money. Before you start your visiting, come to an agreement with your kids on what you would like them to do with the collected ang pows.

Here are a few examples for the different age groups.

- Preschooler – Kindergarten: Pass all ang pows received to daddy or mummy. Let them know that it is rude to open the ang pow in front of the giver.

- Primary One to Primary Six: Allow them to hold on to their collections till the last day of the Chinese New Year. At this age, kids love to count and compare the number of ang pows they have collected, rather than the value in the collections.

- Secondary School and above: Let them manage the collection, both in terms of the number of ang pows received and the amount collected. The only time you may have to intervene is how they will be distributing the money collected, using the money jars system.

Tip #2: Divide and Conquer

It is a good habit for children to immediately split their ang pow money into three jars – Spending, Savings and Giving.

Normally, in your child’s daily allowance, the distribution would be 70% to the Spending Jar, 20% to the Savings Jar and 10% to the Giving Jar.

However, for the ang pow money, Ernest recommends putting 70% to the Savings Jar, 20% to the Spending Jar and 10% to the Giving Jar.

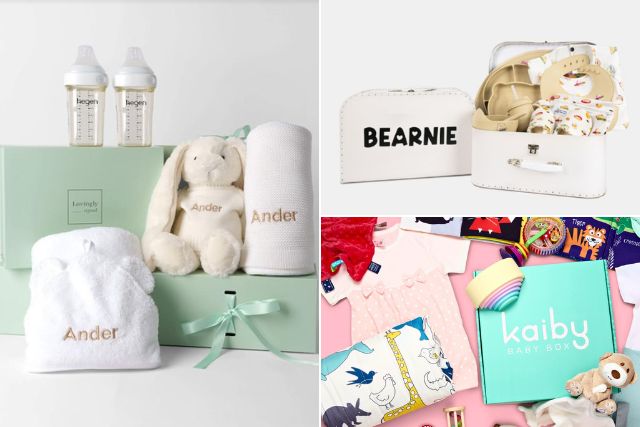

Image: Jopez Academy Money Jars

Image: Jopez Academy Money Jars

The distribution of money into the jars depends on your family circumstances and how well your children can handle money at their age.

If the collection sum is large, you can always tweak the percentages accordingly – e.g. 80% to Savings Jar and 10% to Spending or Giving Jar instead. Or have a maximum cap on how much ang pow money they can use to spend for themselves.

For example, if grandma gives a ‘big’ ang pow to all her grandchildren, you may consider making this an exception and exclude her ang pow from the Money Jars system and directly bank it into their account.

But before doing so, it is always good to discuss and come to an agreement with your kids on the percentage of money that goes into the three different jars.

To have a better idea of how to use the Money Jars system, grab a copy of his book Raising Financial Savvy Kids.

Tip #3: Why must I give back?

It is important to have discussions and talk about giving back. “Bring them along when you make a certain donation. Or you can also take this chance to talk to them about the recent catastrophes that happened and how they can help by making a sum of donation to help the people there.

The more you expose your children to acts of generosity; it slowly becomes ingrained and practice and habit that your child may adopt as they grow into adulthood.” Ernest adds.

Tip #4: Talk about the concept of spending, saving and giving consistently

Don’t just talk about money during CNY, keep the discussions on. The Money Jars system is a stepping stone for your kids to learn about money management. Once your child is aware of the system and has an idea of how much to allocate their allowance, this is the perfect time to discuss with them about their choices.

For example, if the total amount received from their CNY collection is $100, how will they use the $10 set aside for giving? Will he buy a toy for his younger sibling or donate to a charity organisation?

There are no right or wrong answers, but the process of discussion will foster a close parent-child bond as you know how they view money and the value of money. This also reinforces the values you wish to inculcate to your children.

⇒ Recommended Read: Does This Make Cents? Getting Your Kids Started On Money Management

Tip #5: Time to go to the bank

When you deposit their ang pow money into their account, make it a point to bring your child when you visit the bank. Studies have shown that kids learnt faster when they participate in activities that are visual and fun.

“By bringing them along to the bank, they witness the entire process and know exactly where their money goes. As they grow up, you can show them how to read the statement in their bank book. For children in the upper primary level, you can start to introduce the concept of interest to them, and show them how their money grow with interest over time.”

⇒ Recommended Read: Setting Up A Bank Account For Your Child In Singapore

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: