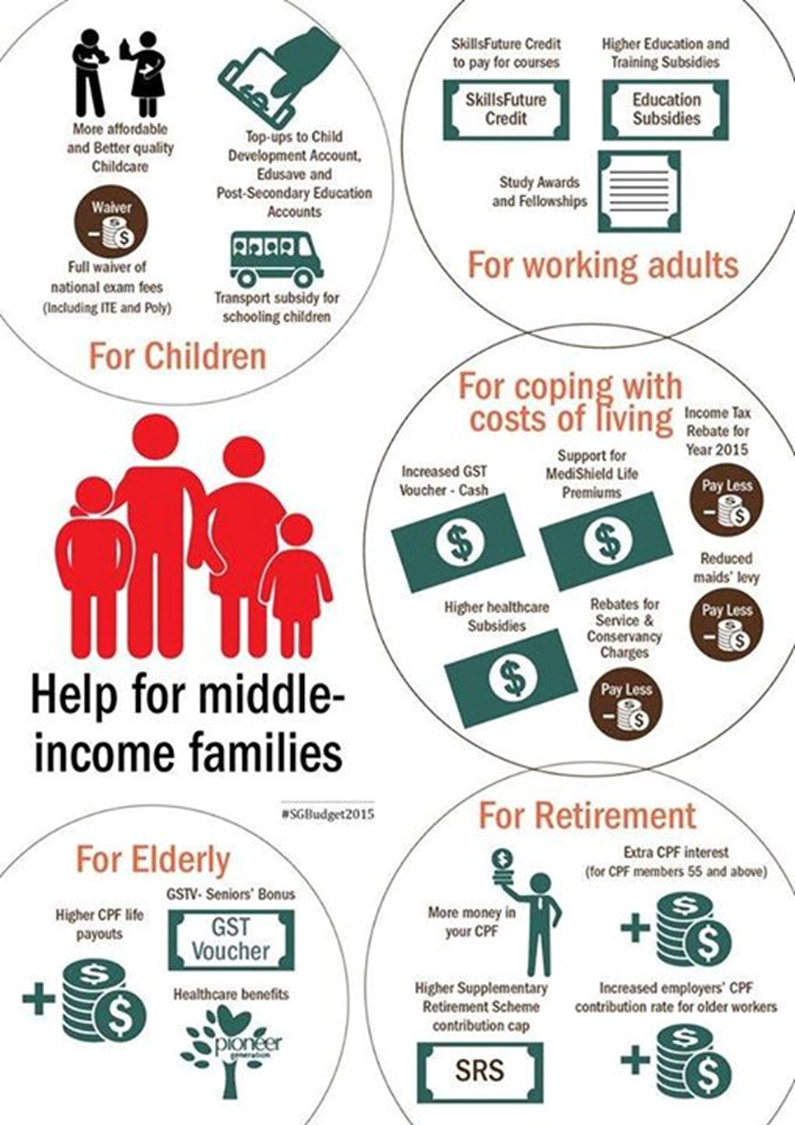

On 23 February 2015, Deputy Prime Minister and Minister for Finance Tharman Shanmugaratnam delivered the 2015 Budget. Before we get down to the details of Budget 2015, here’s a quick Budget fact all Singaporeans should know.

What is the Singapore Budget all about?

In a nutshell, it is a report indicating how our government spends our country’s available funds. Each financial year, which begins on 1 April and ends on 31 March of the following year, the government will review the existing budget. Changes are proposed and discussed in Parliament, and once it’s approved (along with the President’s assent), the budget is passed as the Supply Act. The budget allocation affects all Singapore citizens, regardless of age, race or income groups.

So how will this year’s budget affect parents and their families in Singapore?

Here is a summary of how it will affect your children, your cost of living and your parents.

Your Children

- More Affordable and Quality Childcare

A new Scheme, Partner Operator (POP) will be introduced to tie in with the current Anchor Operator (AOP) scheme. Schools under the AOP scheme are required to keep their monthly fees below $720, in return for subsidised rent and a grant that can be used to improve the quality of the school’s services.

The Government will also give a one-off top-up to the Child Development Account (CDA) for every child up to the age of six this year.

If you live in a home with an *annual value of up to $13,000, your child gets $600.

If you stay in a home with an annual value of more than $13,000, your child gets $300.

*Annual value refers to the estimated annual rent of property if it were to be rented out for a year.

- Top Up Child Development Account

Savings that you deposit into your children’s Child Development Accounts are now matched dollar-for-dollar by the Government, up to a cap of between $6,000 and $18,000. This depends on the birth order of your child. This is to help families pay for their children’s preschool fees.

More information can be found here.

- Full waiver of Examination Fees

From 2015, examination fees for Singaporeans sitting for national exams in Government-funded schools will be waived. This covers fees for the Primary School Leaving Examination (PSLE), and GCE N, O, and A levels.

How much do you save? Up to $900.

Coping with Your Costs of Living

- Decrease in Maid Levy

Households eligible for the Foreign Domestic Worker Levy Concession will enjoy a further discount on the monthly levy. Employers of foreign maids now pay $265 a month in levies, or $120 if they qualify for a concessionary rate. The concessionary rate will be cut to $60.

Are your children below 16? The concessionary levy will also be extended to families with children aged below 16 years (in the past the age cap was 12 years old).

This takes place from 1 May, 2015.

- Increase in GST Voucher

From this year, Singaporeans will get $50 more in Goods and Services Tax (GST) Vouchers. The increase means that eligible individuals will receive up to $300 in cash.

Introduced in 2012 to help lower and middle-income households with their expenses, the GST Voucher is given in three parts – cash, Medisave and Utilities-Save, which provides HDB households with a rebate to offset their utilities bills.

Your Work

- $500 Credit To Upgrade Your Skills

As part of the SkillsFuture Credit from the Government, all Singaporeans aged 25 and above will get an initial $500. This will be topped up at regular intervals and will not expire. Singaporeans can either choose to go for a short course with the $500, or accumulate credits for more substantial training in the future.

Leg up from other organisations

e2i

To help every Singaporean worker to be future-ready as Singapore undergoes economic restructuring and transformation, e2i allows you to set up an individual training account and hold seminars and workshops. With the aim of developing better skills through professional development, and improving productivity for companies, e2i serves all segments of workers, from rank and file to professionals, managers and executives.

Visit e2i.com.sg for more information.

Your Aging Parents

- Senior’s Bonus GST Voucher

Before the Silver Support Scheme kicks in, senior citizens who are aged 65 and above, live in Housing Board flats, and whose assessable income for 2014 is $26,000 or less, will receive a one-off “Seniors’ Bonus”.

The bonus of either $150 or $300 will be in the form of Goods and Services Tax (GST) vouchers and will be on top of the vouchers for those aged 21 and above. The amount seniors will receive will be based on the annual value of their home as at Dec 31, 2014.

For the full report on Budget 2015, go here.

Source: Chan Chun Sing Facebook

Source: Chan Chun Sing Facebook

* * * * *

What do you think of this year’s budget? Share your thoughts with us in the comment box below!

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: