Were you also eagerly awaiting the 14th of February, 2023 – not just because it was Valentine’s Day?

Well, we were, because it was also the day that Minister Lawrence Wong, Singapore’s Deputy Prime Minister and Finance Minister, delivered the 2023 Budget statement in Parliament!

So what benefits can working parents look forward to? Read on!

More Paternity Leave for Dads

Fathers out there would likely agree that caregiving responsibilities shouldn’t fall solely on your wives. In fact, more fathers are becoming really hands-on these days, as compared to a decade or two ago! We understand how busy fathers could do with more paid time off to help look after their little ones.

Well, it seems that the Government concurs, and wants dads to be actively involved in their children’s lives.

Many studies, internationally and in Singapore, have shown that children with more involved fathers have better physical, cognitive, and emotional developmental outcomes! DPM Wong shared that the Government will double Government-paid paternity leave from the current two weeks to four weeks for eligible working fathers of Singaporean children. This applies to children born on or after 1 January 2024.

As parents, what are your thoughts? Since August 2022, NTUC has been engaging working parents among other workers through the #EveryWorkerMatters Conversations. You can share your thoughts, wishlist, and concerns at conversations.ntuc.sg.

Additional Support for Working Mothers

Being a working mother is rewarding, but it’s no secret that it’s also a tough job!

Thankfully, more support will be given to lower and middle-income working mothers, in the form of the amended Working Mother’s Child Relief (WMCR).

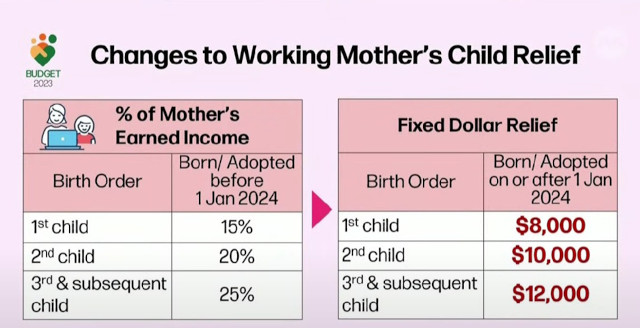

At present, the WMCR is pegged at a percentage of a mother’s earned income – 15% for the first child, 20% for the second child and 25% each for the third child and beyond.

From 1 January 2024, the new scheme will see the WMCR set at a fixed dollar value of $8000 for the first child, $10,000 for the second child and $12,000 each for the third child and beyond.

More Unpaid Infant Care Leave

Infanthood is a precious time. As new parents, we are always looking forward to more time to bond with our little ones.

Well, you’ll be happy to know that unpaid infant care leave will be increased to 12 days per year, up from the current six. Yay to more family time!

This will take effect from 1 January 2024, for each parent with Singaporean children under two years old. The six additional days would definitely help parents with infants better schedule their time with the many vaccinations, and sleepless nights.

Enhanced Baby Bonus & CDA

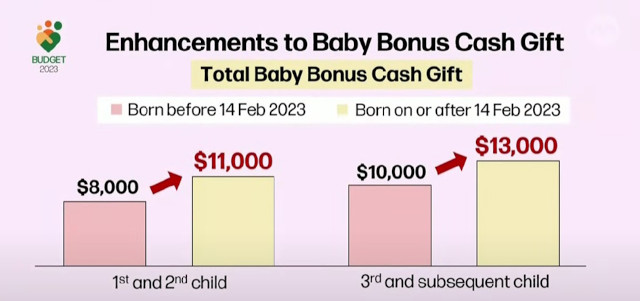

There’s more good news for couples looking to start a family too. From 14 February 2023, the Baby Bonus Cash Gift will be increased by $3,000.

The cash gift will also be paid out over a longer period, enabling parents to receive continuous support till their child enters primary school.

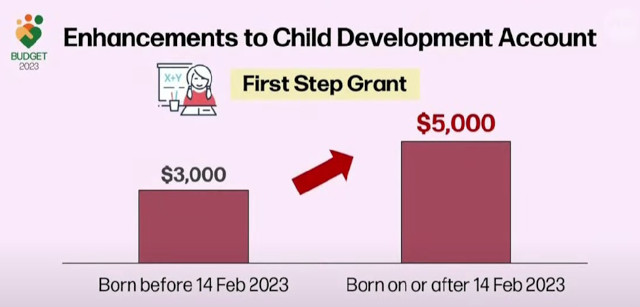

Government contributions to the Child Development Account (CDA) for all eligible Singaporean children will rise as well. The First Step Grant will be raised from $3,000 to $5,000.

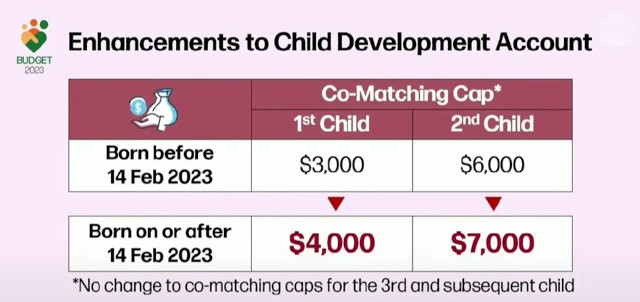

Also, the Government co-matching cap will increase by $1,000 for each child. This means that the Government co-matching cap of $3,000 and $6,000 for your first and second child, respectively, will be increased to co-matching caps of $4,000 and $7,000.

GST, CDC and uSave vouchers

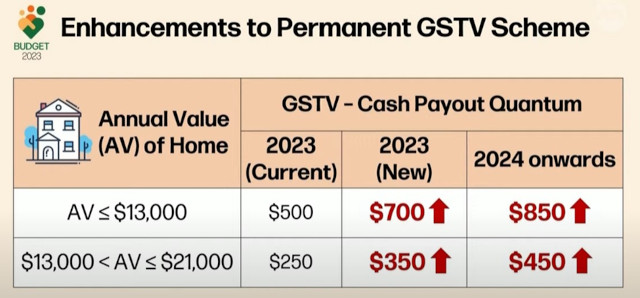

To help mitigate the impacts of the GST increase, the Government has enhanced the permanent GST Voucher (GSTV) Scheme.

Those residing in homes with Annual Values of $13,000 and below will receive the GSTV cash quantum of $700 in 2023, and a further $850 in 2024.

For those with homes of Annual Values between $13,001 and $21,000, a GSTV cash quantum of $350 will be given in 2023, and a further $450 in 2024.

All Singaporean households can also look forward to another $300 worth of CDC vouchers in January 2024. Definitely helpful considering how the costs of baby formula and diapers can all add up!

Additionally, more U-Save vouchers will be distributed to help families with household bills. Singaporeans living in HDB flats (whose household members do not own more than one property ) will receive vouchers ranging from $220 to $380 per year.

Continued Support for Working Parents

The NTUC has been advocating to support all workers in the workforce. And it looks like their calls have been heard with the announcement of doubling voluntary paternity leave and unpaid infant care leave.

“Together with the normalizing of Flexible Work Arrangements, this will go a long way to ensure that caregiving responsibilities are shared and our women workers can reach their full potential in the workplace or at home!”, Ms Yeo Wan Ling, Director, U SME and Women & Family Unit, NTUC further shared.

As a working parent, are you encouraged by this year’s budget announcements? What more will help you and your family?

Share your thoughts here!

This post is brought to you in collaboration with NTUC.

By Rebecca Wong.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: