Wendy was 34 years old when she was pregnant with her first child. As a first-time parent, she was very excited to meet her baby boy. And while she hoped that everything would go smoothly, she was also worried about unexpected events that might occur during her pregnancy period.

To ease her worries, her husband suggested for her to get a maternity insurance plan which could help offset any unforeseen medical costs.

Fortunately, she heeded her husband’s advice. Even though she is fit and healthy with no pre-existing health issues, her newborn was diagnosed with Congenital Diaphragmatic Hernia, a condition in which the baby is born with a defect in the diaphragm.

This abnormal development of the diaphragm may cause the stomach and intestines to move into the chest cavity and crowd the heart and lungs, which may, in turn, lead to the underdevelopment of the lungs and potentially result in life-threatening breathing difficulties. The doctors said that such a condition is rare.

“It felt like the world came crashing down on us,” Wendy recalled.

After the doctors informed the couple that the baby requires major surgery, Wendy broke down immediately. Filled with anxiety, her husband called their friend Ryan, who is also their financial services consultant, for advice.

It was midnight then, but Ryan quickly rushed down to the hospital to visit them. Throughout the entire duration of the surgery, the whole family, together with Ryan, stood outside of the operating theatre, praying hard. After an arduous four hours, the team of doctors and nurses finally appeared.

“The operation was a success,” they said.

Wendy collapsed in happiness. She was finally able to breathe normally.

This is based on a real-life story, shared by Ryan. The AIA Mum2Baby Choices maternity insurance plan that Wendy bought earlier helped to ease the financial burden from the unexpected illness. The costs of hospitalisation including the ICU stay, as well as post-hospitalisation claims, were all fully covered for under the plan.

Additionally, Wendy was also able to receive a payout every day under the daily hospital care benefit. The best part was that the claim only took around one week to process. With the medical finances being taken care of, Wendy could concentrate wholly on taking care of herself and her baby.

It has been two years since the surgery and the baby is recovering well. Even though he is still slightly underweight, he could eat and play like every other child. It is truly a blessing!

Is a maternity insurance plan good in securing comprehensive coverage for you and your child?

Indeed, pregnancy is a time of excitement and yet also a time of uncertainty. It could bring about stress and anxiety, especially for first-time parents.

While Wendy’s experience may seem uncommon, one thing’s for sure – it is difficult to foresee the unpredictable events of the future. One way to manage this is to ensure that you are financially prepared for childbirth and parenthood with comprehensive maternity insurance.

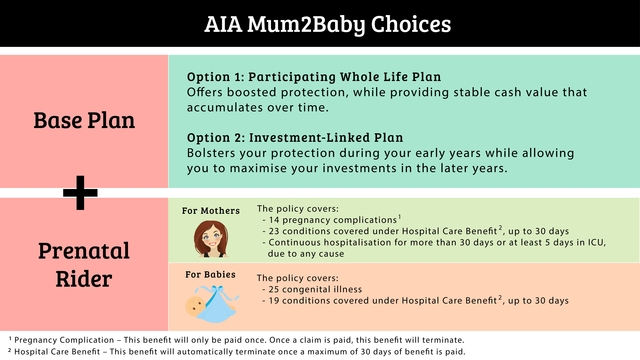

Did you know that the AIA Mum2Baby Choices can be bought as early as thirteen weeks into pregnancy? Please see the product summary below for more information:

The above diagram is for illustration purposes only. Please refer to the product brochure for more details on the covered conditions.

As parents, we want the best for our children and giving them a head start in life is our topmost priority. With the flexibility to transfer the policy to the child within 60 days from birth without a need for any medical declarations, the policy will translate into guaranteed lifelong protection for your child, up to age 100.

Nobody can predict what will happen in the future, so it is important to stay protected at all times!

A quick search on the Internet on maternity insurance plans brings up a variety of jargons such as “hospital cash benefit” and “childbirth medical negligence³”.

With Elite Advisory Services, we make the process of searching for a maternity plan easy and hassle-free. We strongly believe that all parents deserve a helping hand and you can count on us to customise solutions to offer greater protection for you and your little ones.

Here’s what Wendy has to say about her experience with Elite Advisory Services:

|

“I was first introduced to the AIA Mum2Baby Choices by my friend Ryan, who is also a financial services consultant at the Elite Advisory Services. I engaged his services not just because he is my friend, but also because I see that he is committed to his job, even rushing down to the hospital to visit me and my baby in the wee hours.

He is very patient in explaining the different policy plans that his company offered and he also took time to find out the things that I am looking forward to in life, before explaining how these plans can help me to achieve my goals.” |

As part of Elite Advisory Services’ tenth-anniversary celebrations, we are now offering a FREE financial consultation for all mothers-to-be! Find out how you can better protect you and your child during pregnancy. The first 50 sign-ups will also receive an additional gift pack worth $50!

Register at this link here: bit.ly/EASmum2baby

This post is brought to you by Elite Advisory Services, an authorised representative of AIA Singapore Private Limited (Reg. No. 201106386R).

³ Childbirth Medical Negligence – If the mother and/or child, unfortunately, passed away due to medical negligence of a Physician, Specialist or Hospital in Singapore or Malaysia, this benefit will pay 100% of the coverage amount, in addition to the Death Benefit for the mother.

General Notes:

There are certain conditions where no benefits will be payable. You are advised to read the relevant policy contracts for details.

Important Notes:

These insurance plans are underwritten by AIA Singapore Private Limited (Reg. No. 201106386R) (“AIA”). All insurance applications are subject to AIA’s underwriting and acceptance. This brochure is not a contract of insurance. The precise terms and conditions of these plans, including exclusions whereby the benefits under your policy may not be paid out, are specified in the relevant policy contracts. You are advised to read the relevant policy contracts.

As buying a life insurance policy is a long-term commitment, early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs. You should consider carefully before terminating the policy or switching to a new one as there may be disadvantages in doing so. The new policy may cost more or have fewer benefits at the same cost.

Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.

The information is correct as at 20 April 2020.

* * * * *

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Stay in touch! Subscribe to our Telegram here for all our latest updates.