Time to file your tax! But before you do that, do you know of these reliefs for parents?

If you are a Stay-at-home Mothers (SAHM)

What: Spouse / Handicapped Spouse Relief

Who can claim: Both male and female taxpayers who have supported their spouses

Eligibility: Your spouse was living with/supported by you; and ^Your spouse did not have an annual income* of more than $4,000#.

The amount you can claim: $2,000 / $5,500 for Handicapped Spouse Relief

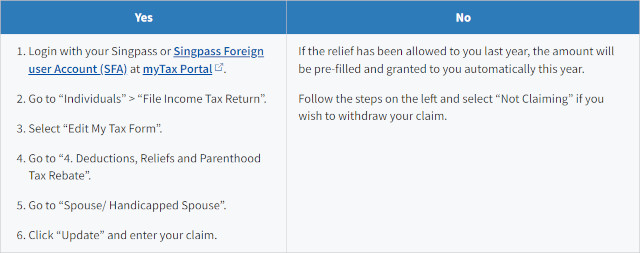

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

Note: If you have claimed Spouse / Handicapped Spouse Relief, none of your children or their spouses are allowed to claim Parent / Handicapped Parent Relief (except Grandparent Caregiver Relief) on your spouse. For example, if you are claiming Spouse Relief on your husband, your child cannot claim Parent Relief on your husband.

If you are a new mother or just gave birth to another child

What: Parenthood Tax Rebate (PTR)

Who can claim: Parents – Married, divorced or widowed Singaporeans

Eligibility: Your child has to be born a Singapore citizen, or become one within the 12 months from birth

Amount claimed: This rebate ranges from $5,000 for your first child (born from 2008 onwards) to $20,000 for your fourth and subsequent child. You and your spouse may also choose to split your rebate into a ratio of your choice. E.g. 50 (husband) – 50 (wife) or 20 – 80.

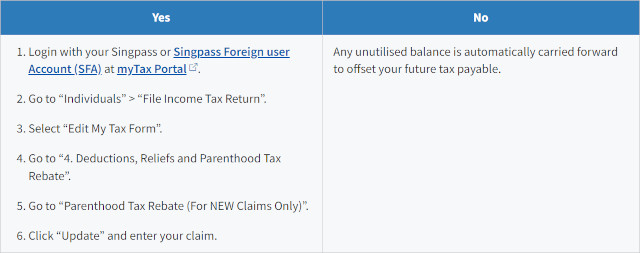

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

If you are a Working Mum

What: Working Mother’s Child Relief (WMCR)

Who can claim: Working mothers who are married, divorced or widowed who have an earned income

Amount: The amount of WMCR that you can claim for each child is based on the child order and the corresponding percentage of your earned income. Starting at 15 per cent of your earned income for one kid, it reaches 25 per cent for your third and subsequent child.

Eligibility: You have a child who is a Singapore citizen and have satisfied all conditions under Qualifying Child Relief (QCR)/Handicapped Child Relief (HCR).

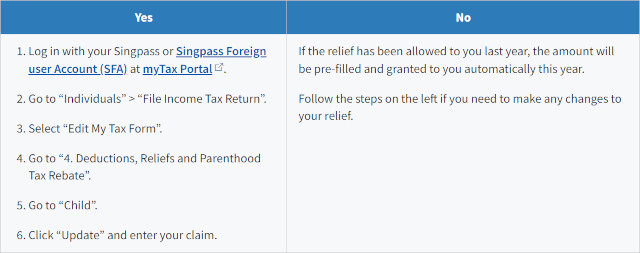

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

If you are a working mother, and/or have a handicapped child:

What: Qualifying Child Relief (QCR) / Handicapped Child Relief (HCR)

Who can claim: If you are a married, divorced or widowed Singapore tax resident maintaining an unmarried child who meets all the conditions below:

1. Your child is unmarried and was/is:

a. Born to you and your spouse/ex-spouse; or

b. Is a step-child; or

c. Is legally adopted.

2. ^Your child was:

a. Below 16 years old; or

b. Above 16 years old and studying full – time at any university, college or other educational institution at any time in the year

3. ^Your child did not have an annual income* exceeding $4,000#

Eligibility: If you child is below the age of 16, and you earn less than $4,000 last year, which includes income from bank interest, dividends and part-time jobs.

Amount: $4,000 per child for QCR, or $7,500 per child for HCR

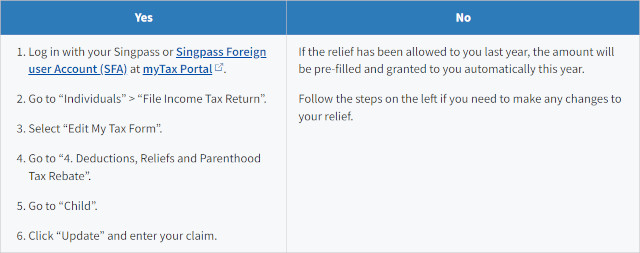

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

Note: If you are a working mother and have met all the conditions for Working Mother’s Child Relief (WMCR), you may claim also claim the Qualifying Child Relief and WMCR on the same child. QCR + WMCR is capped at $50,000 per child.

If your parents are helping you to look after your child

What: Grandparent Caregiver Relief

Who can claim: working mothers who engage the help of their parents, grandparents, parents-in-law or grandparents-in-law (including those of ex-spouses) to take care of their children.

Amount: $3,000 on one of your parents, grandparents, parents-in-law or grandparents-in-law.

Eligibility: Your parent, parent-in-law, grandparent, or grandparent-in-law (including that of ex-spouse) has to be living in Singapore, and not working. Your child must be younger than 12 years old and a Singapore citizen.

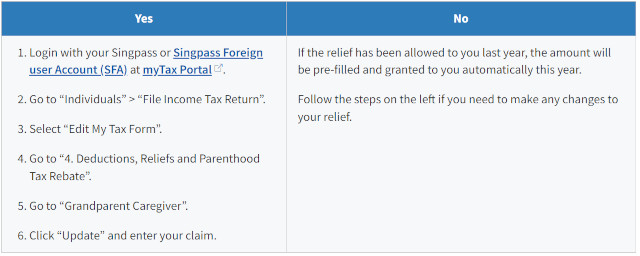

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

If you have a foreign maid at home

What: Foreign Domestic Worker Levy (FDWL) Relief

Who can claim: If you have an employed foreign domestic worker and you are married, lived with your husband, or separated from your husband, divorced or widowed. Single taxpayers or male taxpayers are not eligible for this relief.

Amount: You or your husband can claim twice the total foreign domestic worker levy paid in the previous year, on one foreign domestic.

If the Ministry of Manpower had approved your application for the Foreign Domestic Worker Levy concession, your FML Relief will be computed based on the lower amount of levy.

This relief can only be used to offset your earned income*.

*Earned income = Taxable earned income from employment, pension, trade, business, profession or vocation less allowable expenses

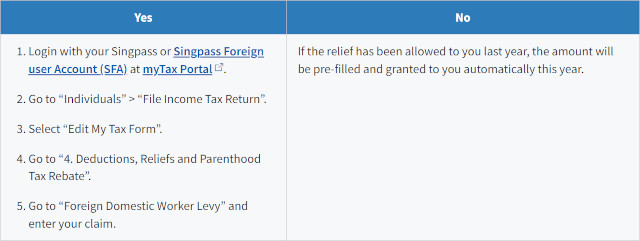

How to claim (online):

Click on the image for more details on how to apply.

Click on the image for more details on how to apply.

Taxes are due on 18 April 2024.

For more details and to check if you qualify for these reliefs, visit IRAS website for more details.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.