Having a place of your own is one of the biggest signs of financial independence. Ideally, your first home would be a place that your family can grow in — so even when you’re planning for kids, it’s no biggie to convert that spare bedroom into a nursery.

Photo credit: Bluenest

Photo credit: Bluenest

But you and I know that the cost of living in Singapore isn’t cheap – even an average 3-room flat can come with a $300,000 price tag. Here’s where all the helpful government schemes and housing grants come in. This article is written for young parent(s) who are:

- First-time married couples with/expecting kid(s)

- Second-time married couples with kid(s)

- Second-time single parent applicants with kid(s)

Here’s the definitive guide to housing schemes and grants for young parents.

Schemes for Young Parent(s):

1. Parenthood Priority Scheme

They say children are gifts from God. Thankfully, this gift includes a priority queue for HDB applications in Singapore.

Benefits: Up to 30% of the Build-to-Order (BTO) and 50% of the Sale of Balance Flats (SBF) are reserved for applicants balloting under this scheme.

Who’s eligible:

- First timer married couples who are expecting their first Singaporean Citizen (SC) child

OR - Couples with at least 1 SC child under 18 who’s the natural offspring of a legal marriage or legally adopted.

Some of you may have had little luck balloting for your preferred residential area. Perhaps you can consider moving your family plans ahead of schedule if you can afford it. This may work to your advantage especially if you’re balloting for a popular area.

⇒ Related Read: 5 Ideal Neighbourhoods to Raise Kids in Singapore

2. Third-Child Priority Scheme (TCPS)

The average Singaporean household size was 3.24 in 2018. A family with more than 2 children is uncommon nowadays, let alone more than 3. However, if you’re one of the more fruitful couples, the TCPS was designed just for you. This may work in your favour, especially if you’re a second-time applicant in search of a larger home under the HDB system.

Benefits: Up to 5% of the BTO and SBF units are reserved for applicants balloting under this scheme.

Who’s eligible:

- Couples in which at least one spouse is a Singapore Citizen OR divorcees/widowers who are Singapore Citizens. Must not have applied for flat previously under TCPS.

WITH - At least 3 children under 16 (SC/PR) who are either the natural offspring of a legal marriage or legally adopted. For divorcees, you must have legal custody of your children.

3. Assistance Scheme for Second Timers (ASSIST)

Thankfully, HDB schemes today offer more aid for different household demographics. This includes widowers and divorcees. If you’re looking for a new place because of life changes, ASSIST may be of help to you. You can start anew in a new environment.

Benefits: Up to 5% of the 2-room Flexi and 3-room BTO flats in non-mature estates are reserved for applicants balloting under this scheme.

Who’s eligible:

- Second-timer applicants who have not acquired any interest in an HDB or private residential property (except for matrimonial properties) after the date of divorce/separation or demise of a spouse.

WITH - At least 1 SC child under 18 who’s the natural offspring of a legal marriage or legally adopted.

4. Multi-Generation Priority Scheme (MGPS)

This scheme doesn’t relate directly to children, but it’s still an important family-centric scheme. Filial piety is a cherished value in Asian culture. If both you (the married child) and your parents want to apply for BTO flats in the same precinct, the MGPS gives you priority. The scheme encourages intergenerational connections and caring for elderly parents.

Benefits: Up to 15% of 2-room Flexi or 3-room flats (minimum of 20 units) are allocated to parents. The corresponding number of 2-room Flexi or larger units are reserved for their married children’s household.

If successful, both parents and married children can choose to live on the same floor (maybe even next to each other) or elsewhere within the range of pre-identified BTO flats.

Who’s eligible:

- Parents who submit a joint application together with their married child and applying for a 2-room Flexi or 3-room flat in a BTO project

- Married children applying for 2-room Flexi flats or bigger

And if/when the kids come along, you can reach out to your parents who are living nearby!

5. Parenthood Provisional Housing Scheme (PPHS)

We all know that HDB sales exercises take time and BTOs can take 3-4 years to build. While some don’t mind the idea of staying with their parents, for the time being, others prefer to have a space to call their own. PPHS helps you find a temporary home at affordable rates in the meantime.

Benefits: Couples who have applied for a flat that is uncompleted enjoy priority under this scheme. Couples can share with another eligible household up to a maximum of 6 people in a 3-room or 4-room flat.

Who’s eligible:

- First and second-timer married couples (with one Singaporean Citizen spouse; the other can be either SC or PR)

- Divorced or widowed parents with child(ren). Parent must be a Singaporean Citizen with at least one child as a SC or PR.

6. Public Rental Scheme (PRS)

HDB does its best to ensure everyone has a home regardless of their financial capabilities. You may be stranded financially due to unforeseen life circumstances. Even when you have nowhere else to turn to, the PRS ensures that you and your child(ren) have a roof over your head.

Benefits: Low-income families are charged a low rental cost to live in a 1-room or 2-room flat.

Who’s eligible:

- First and second-timer married couple applicants (one spouse must be a Singaporean Citizen & the other should be either an SC or PR. Monthly household income must be less than $1500.)

- First and second-timer divorced parents with child(ren)* (Parent must be a Singaporean Citizen with at least one SC/PR child. Monthly household income must be less than $1500.)

*If your child is under 21 and custody is shared with your ex-spouse, you’re required to get his/her written consent for the flat application.

Grants for Young Parent(s):

1. Proximity Housing Grant (PHG)

Are you looking at childcare help from your parents? Is your place currently too far from your parents’ place? The Proximity Housing Grant may be of great help to you. This grant helps to shave a tidy sum off your purchase costs. You can direct the money saved towards renovations or invest it for your child’s education.

⇒ Related Read: Grandparents Or Childcare? Important Factors To Consider

However, the PHG only applies to resale flat purchases. You can get anything from a 2-room to 5-room resale HDB near your parent(s). You can join 20,000 over households to benefit from this scheme today.

Benefits:

Married Couples

- $30,000 (if living with parents in the same residence),

- $20,000 (if living within 4km of parents’ flat)

Single Parent

- $15,000 (if living with parents in the same residence),

- $10,000 (if living within 4km of parents’ flat)

Who’s eligible:

- Married couples with at least one spouse who’s an SC or PR

- Aged 21 and above (for married couples), 35 and above (for single parents)

2. Family Grant

Maybe you recognise that with your current income the price tag of a resale flat may be a little burdensome for you. The Family Grant is designed to provide financial support with up to $50,000 worth of subsidies.

Note that the Family Grant only applies to the purchase of resale flats. This is a better move if you have or intend to have multiple children. Resale flats are much larger and better able to house an expanding family (with/without your parents living with you).

If you’re a single parent with custody of your child(ren), you too are eligible for the grant! Better yet: if you purchase the flat with your extended family, you’ll enjoy a larger latitude in your monthly household income to qualify for the Family Grant.

Benefits:

Married Couples (Both SC)/Single Parents Who Are Related

- $50,000 (2 to 4-room)

- $40,000 (5-room or bigger)

Married Couples (SC & PR)

- $40,000 (2 to 4-room)

- $30,000 (5-room or bigger)

Who’s eligible:

- Married couples with at least one spouse who’s an SC or PR. Both applicants must be aged 21 and above.

- First-timer buyers who have not received any housing subsidies or CPF grants.

Other requirements:

- Never previously owned a flat bought from HDB (ECs and DBSS flats included)

- Not owned or sold any property locally or internationally within the past 30 months

- Average monthly income below $14,000 (immediate family) or $21,000 (extended family)

*Note that you can’t invest in private residential property until you’ve fulfilled the 5-year MOP, nor can you buy an HDB resale under SERS.

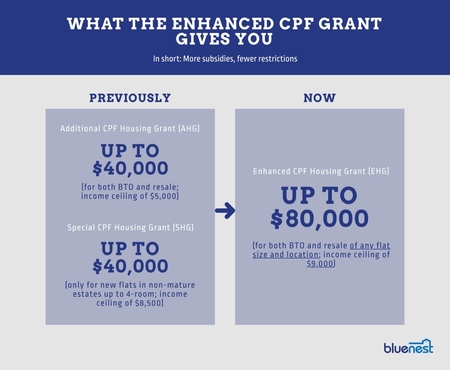

3. Enhanced CPF Housing Grant (EHG)

The EHG further lessens your financial burden with up to $80,000 in subsidies. This benefits mainly lower- and middle-income families. Unlike its predecessor, this newly introduced EHG has no restrictions in its choice of flat type and location:

Enhanced CPF Grant Summary (Photo credit: Bluenest)

Enhanced CPF Grant Summary (Photo credit: Bluenest)

The higher your monthly household income, the less in subsidies you’ll get. This grant is available for both married couples and single parents.

Benefits:

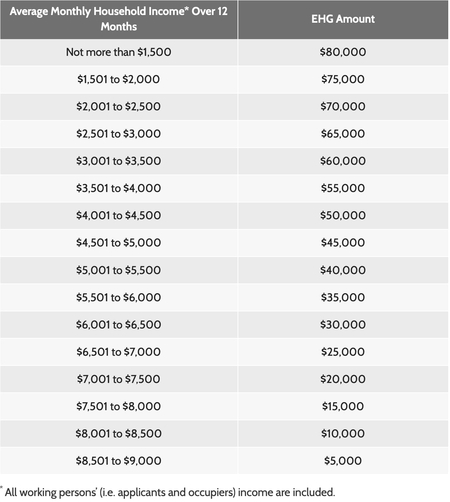

Married Couples

- Up to $80,000 in grants (as seen in Table 1 below)

Table 1: EHG Grant Amount (Photo credit: HDB)

Table 1: EHG Grant Amount (Photo credit: HDB)

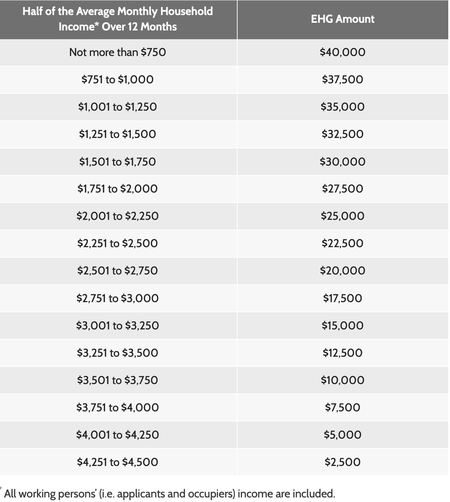

Single Parents (first and second-timers)

- Up to $40,000 in grants (as seen in Table 2 below)

Table 2: EHG Grant Amount – Singles (Photo credit: HDB)

Table 2: EHG Grant Amount – Singles (Photo credit: HDB)

Who’s eligible:

- Married couples who qualify for the Family Grant. At least one spouse must have worked continuously for 12 months before the flat application and still be working during the application. Your average monthly household income should be less than $9,000 for the 12 months before application.

- First-timer Single Parent applicants with an average monthly household income of less than $4,500 for the 12 months before application. You must still be working during the application and should not own any other property.

4. Half-Housing Grant

Worried that you aren’t eligible for any grants after accessing them as a Single Citizen the first time around? Fret not. There’s still the Half-Housing Grant you can apply for. This grant tops up the amount you’ve already gotten as a Single Citizen, giving you another $25,000 (half of the Family Grant). It’s only applicable for resale flats.

Benefits:

Married Couples/Singles

- Up to $25,000 (2 to 4-room)

- Up to $20,000 (5-room or bigger)

Who’s eligible:

- Married couples who qualify for the Family Grant (with one spouse as a second-timer applicant)

*Like with the Family Grant, you can’t invest in private residential property until you’ve fulfilled the 5-year MOP, nor can you buy an HDB resale flat under SERS.

That’s a wrap to all the schemes and grants you can access so far! Each scheme and grant cater to different groups as well as toward BTO or resale flats. We hope that you and your family find a good home to settle in!

This article was contributed by Bluenest.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: