Teaching our children how to save with just one coin box isn’t enough. Financial literacy is a skill that entails more than just knowing how to put aside money for a rainy day.

Delaying financial literacy until your child is an adult may cost him/her precious opportunities to practise various aspects of this skill as he/she grows up.

Such opportunities include moments where your child begins to ask you incessantly to buy toys, handling daily allowances from Primary 1, purchasing items from the yearly school booklist for the next year, having his/her first bank account and smartwatch for payments at Primary 3, and managing debit cards during the teenage years.

How can you teach your children financial literacy skills from ages as early as three?

The Institute for Financial Literacy (IFL) has created a series of free printable called MoneySense for Your Child learning and activity kits.

These colourful kits teach parents the importance of inculcating good financial habits in children from young. By teaching and modelling healthy financial habits to your child, he/she is not only able to save more but grow up having a better understanding of financial literacy concepts.

Inside each kit, there are various activities which educate parents on how to teach age-appropriate messages to their children, such as budgeting, practising delayed gratification, differentiating between needs and wants.

Financial Literacy for 3 to 6-Year-Old Children

Although parents of preschoolers largely control our children’s spending, the preschool years are a good time to start your child on financial literacy skills.

In IFL’s MoneySense for Your Child free printable for 3 to 6-year olds, your child will be introduced to the concept of prioritising needs over wants. By engaging your child with the activities included in the free printables, he/she will learn to differentiate needs versus wants and how to apply this concept to daily household items.

Another concept taught is the concept of saving, spending and sharing. In the activity, your child will learn the different denominations of currency and how to consider trade-offs when shopping on a limited budget.

Virtues of filial piety and prudence are also inculcated through the activities, which will come in useful when your child grows up and looks after both parents, and his/her own children too.

Download the free printable for 3 to 6-year-olds here.

Financial Literacy for 7 to 12-Year-Old Children

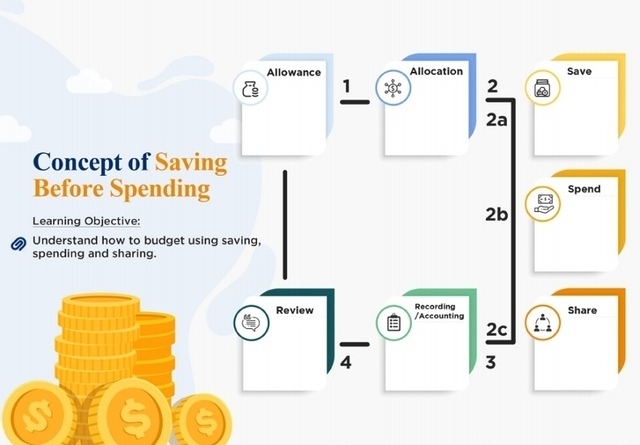

When your child goes to primary school, he/she will have a daily allowance. Having a strong concept of saving before spending will help your child better manage his/her allowance.

Good money sense habits will also prevent undesired situations such as habitual borrowing from classmates (which happens even though it is not allowed in schools) or throwing tantrums when you refuse to buy the latest gadget for him/her.

The IFL’s MoneySense for Your Child free printable for 7 to 12-year olds contains activities to teach the concept of saving before spending, delayed gratification and budgeting skills.

This handy kit comes with a useful ‘Pocket Money Routine’ to guide your child through the ‘Saving, Spending, Sharing’ concept of allocating one’s allowance and how to keep track of where the money goes to.

Download the free printable for 7 to 12-year-olds here.

Financial Literacy for 13 to 16-Year-Old Teenagers

As your child grows into a teenager, he/she will need to make more independent financial decisions with a larger allowance. This is a great time to teach him/her how to become a smart consumer.

Parents can download the free printable for 13 to 16-year-old teenagers which comes with tips on how to budget using a savings goal activity, how to spot a good deal and how to avoid scams.

From this kit, your child will be introduced to the powerful concept of compound interest, become familiar with different payment methods such as debit and credit cards and learn precautions he/she should take when shopping online.

Download the free printable for 13 to 16-year-olds here.

What other resources are available?

The Institute for Financial Literacy (IFL) also organises regular talks online. Register for these talks at www.ifl.org.sg/events.

As children can grasp financial concepts like saving and spending from as young as 3 years old, our role as parents plays an important part in this process to help our kids learn Money Sense and inculcate sound financial habits that will benefit them all the way to retirement.

This post is brought to you by the Institute for Financial Literacy (IFL).

By Julia Chan.

Stay in touch! Subscribe to our Telegram here for all our latest updates.

Want to be heard and seen by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.