We all know raising a family, especially one with few kids in Singapore is never easy on the wallet. Despite the high cost of living, many choose to work and live here for the benefits of high-quality education, good quality of life, and safety.

Some choose to work hard to make more money. Some find ways to have their money ‘work’ harder to generate more returns. The latter group has various avenues to park their money, which include properties, insurance policies and equities.

As for the conservative group, they are often left with only one choice: bank deposits. Although there are other low-risk instruments available that pay better rates such as government bonds and money market funds, unless one is financially-savvy, such products generally are not well-understood and thus shunned. Fixed deposits (or FDs) pay higher interest than saving deposits, however, there are certain limitations that deter savers from putting money into FDs.

This is where the Singapore Savings Bond (SSB) comes into the picture. The SBS is a new saving product which means to generate better returns than deposits yet remaining flexible, easy and very safe for anyone eligible to park their money.

What is SSB and why is it considered safe to invest?

Issued by the Singapore government, the SBS principal and interest rates are guaranteed by the government, similar to how CPF-OA monies are being guaranteed at a fixed rate. This is not a compulsory saving scheme and the funds are not locked in. There is, however, a waiting period of a few days to a month during redemption as the bonds can be redeemed anytime in exchange back of the principal amount plus accrued interests.

Interests offered by SSB will generally be higher than savings deposits offered by banks. One can expect the rates to be similar to fixed deposits. But unlike fixed deposits, SSB can be terminated or redeemed anytime without penalties.

To add on, SSB allows one to hold up to 10 years (most FDs have a maximum tenor of 24 or 36 months), thus earning more returns as the interest rate of SSB will be ‘stepped up’ after each year. One SSB will be issued each month, and the interest rate might not be the same for each issuance.

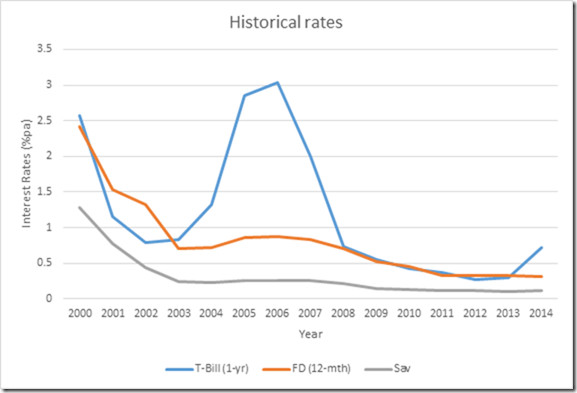

The interests paid by SSB are in-line with what the Singapore Government Securities (SGS) are paying. The diagram below shows the average historical rates of the SGS, FD (Fixed Deposit) and Saving Deposit in the past 15 years.

(Source: Monetary Authority of Singapore)

(Source: Monetary Authority of Singapore)

So how much returns can one expect from SSB?

As an indication, the current 1-year T-bills yields about 1%, while that of a 2-year bond is about 1.15%, we can expect an SSB (if one is to be issued now) to pay you about 1% for the first year, and then probably 1.3% in the second year (thus average of 1.15% pa over 2 years).

Given a likely higher interest rate environment going forward, we can also expect the SSBs to give similarly higher returns.

For parents and individual-alike, SSB offers a good saving alternative for various purposes where the safety of the principal amount cannot be compromised, such as saving for children’s education or setting aside emergency funds.

Applications for Savings Bonds will open in the second half of 2015.

By Shares Interest

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.