Everyone should have different pots of monies set aside for different purposes. In order to achieve their financial goals, one must be clear where their monies are going and if the monies are growing. Here are some examples of the different pots of honey, I mean money, one should have.

1. Emergency Fund

This is the first pot of money everyone must-have. One should have 6 – 12 months of living expenses available at a moment’s notice, for emergency uses. Typically the pot of money is in a normal bank savings account or a time deposit (fixed deposit) where one can withdraw the cash quickly.

However, due to the ease of withdrawal, the interest rates for bank savings and fixed deposits, are typically very low. 0.05% to 0.5% per annum for bank savings accounts and 0.05% to 1.35% per annum for the fixed deposit accounts.

2. Spare Funds

Any funds in addition to an emergency fund that is sitting in a normal bank savings account are diminishing in purchasing value over time. Singapore’s long-term average compounded inflation rate is 1.99% per year, which means if your bank interest rate is 1%, your bank savings are shrinking in value by 0.971% (inflation-adjusted rate) every year! Over a period of 10 years, your S$100,000 would become S$90,706 (in terms of purchasing value)!

I cannot emphasise more the importance of utilising and maximising your spare funds to higher interest-yielding instruments. However, you should know how to divide your spare funds into different pots as well.

3. Short Term Goal

Do you have a short-term financial goal you want to achieve? Short Term Goals are between 1 – 5 years. Examples of these goals include marriage, buying a house, car, further education, dream travel destination.

One should typically put this pot of money in time deposits or bonds with a yield of at least 2% per year.

4. Medium Term Goal

Medium-Term Goals are between 5 – 10 years. Examples of these goals include paying off your housing and car loans, dream travel destination.

One should typically put this pot of money in bonds with a yield of at least 2% per year or Unit Trusts/Investment-Linked Funds with a Low – Medium risk portfolio.

5. Long Term Goal

Long Term Goals are more than 10 years. Examples of these goals include paying off your housing loans and retirement planning.

This pot of money should be going into endowment (saving) plans or Unit Trusts/Investment-Linked Funds with a Medium – High-risk portfolio.

Let me now discuss in more detail the different types of savings and investment instruments I have mentioned above.

Different Types of Instruments

When it comes to savings and investments, there are so many instruments and asset classes out there that it can be compared to the myriad of colours that nature had come up with.

6. Bank Savings & Time (Fixed) Deposits

- Interest rates for these 2 types of deposits have went below 1% per year since late 2008 and have remained low till now.

- Long Term interest rates will most likely not be higher than the long term inflation rate.

7. Bonds (Fixed Income)

- Bond, or Fixed income, investments generally pay a pre-determined rate of interest over a stated time period. At the end of the time period, the investor’s principal will be returned.

- More stable than stocks.

- If one is looking to trade their bonds, the current value is determined by current interest and inflation rates.

8. Endowments (Savings)

- Typically used as a long term savings instrument for a fixed time period.

- Fairly stable over the long term as bonuses are added every year after the 3rd year.

- Principal with bonuses is returned at the end of the fixed period.

- For more details on endowments, you may refer to my previous article (Different Types of Financial Products) in the New Age Parents Feb/Mar edition.

9. Equities

- Also called stocks, equities represent shares of ownership in publicly listed companies. Examples include DBS, Singtel, Apple, Facebook.

- Historically have outperformed other investment assets.

- Most volatile in short term.

- Returns and principal will fluctuate so that capital gains, when the shares are sold, may be worth more or less than original investment cost.

10. Unit Trusts / Investment-Linked Funds

- This is also known as Mutual Funds in United States.

- This is defined as an investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments (or equities). Mutual funds are operated by managers, who invest the fund’s capital and attempt to produce capital gains and income for the fund’s investors. A mutual fund’s portfolio is structured and maintained to match the investment objectives stated in its prospectus (As defined by Investopedia).

- Smaller capital outlay to start off.

- Provides access to professionally managed, diversified portfolios and premium shares (e.g. Facebook, Apple) which may involve huge capital outlay if purchased directly by investors themselves.

- Typically more well-diversified compared to buying equities directly.

11. Real Estate

- Your home or investment property or shares of funds that invest in commercial real estate (E.g. Real Estate Investment Trusts).

- Helps protect future purchasing power as property values and rental income typically run parallel to inflation.

- Values tend to rise and fall more slowly than stock and bond prices. It is important to keep in mind that the real estate sector is subject to various risks, including fluctuation in underlying property values, expenses and income and potential environmental liabilities.

- Large capital outlay compare to other investments.

12. Alternative Investments

- Alternative investments like wine, land parcels, gold, minerals, oil, commodities and Foreign Exchange trading are fairly complicated and volatile, which I will not dwell into in this article.

- Quite volatile and unpredictable, not suitable for Short, Medium and Long Term goals.

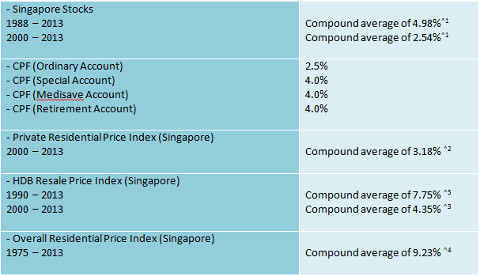

13. Return on Investments (ROI) of some asset classes

The purpose of this article is to provide an over-arch of investments. The one resource I constantly refer to is Investopedia. A good financial planner should also add value to you by working out your financial goal and recommending the right instrument for you to achieve them. And as the saying goes, “When you go to a casino, play the games that you know!” The same applies to investments. Read up on the investments before you invest and enjoy the process!

Do share your thoughts, ideas and questions on The New Age Parents Facebook Page or you could simply drop me an email at tanooisim_winston@hotmail.com.

By Tan Ooi Sim Winston, Chartered Financial Consultant.

Sources:

^1 Source: STI (From Jan-1988 to Dec-2013)

^2 Source: H88 Property Stats

h88.com.sg/property_stats/property_price_index.php

ura.gov.sg

^3 Source: HDB InforWEB (from Q1-2000 to Q4-2013)

^4 Source: Trading Economics Singapore Property Price Index

tradingeconomics.com

investopedia.com

How To Invest And Grow Your Money Series:

Part 2: Investment Basics 101

Part 3: Different Investment Styles

Part 4: Important Indicators To Look Out

Part 5: Important Facts To Know Before Investing

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: