With the advent of medical science, many people are living to a riper old age. Statistics have proven the more developed the economy is, its people will have a higher life expectancy.

From a life expectancy of 65.8 years old in 1970, Singaporeans’ life expectancy have grown substantially to 82.3 years old in 2012 ^1. Retirement planning is increasingly becoming a very important component in financial planning, especially so for our “hamburger” generation.

When Should I Retire?

I have always told my clients that retirement planning is about giving them a choice of not working when they reach their desired retirement age. They may choose to continue working after their retirement age, but at least they have a peace of mind that their retirement is already taken care of and do not need to work for the money’s sake.

So how should you decide your retirement age? There are a few steps involved here.

1. Deciding When And How You Want To Retire

A typical retiring age for my clients whom I have done retirement planning with falls between 55 to 65. Once you have decided when you want to retire, you need to think of how much retirement income you need every month to sustain your lifestyle should you retire now.

If you were to retire now, do you believe S$3,000 per month is enough? Or would you prefer S$5,000? What kind of retirement lifestyle would you like to lead?

If you would like to maintain your current lifestyle, you can use your current monthly expenses as a benchmark for your future retirement income.

2. Working Out How Much Retirement Funds You Need

Working out how much lump sum a person needs for their retirement is quite technical, it would be advisable to get a good financial planner to help you do the sums. Typically, a person retiring 25 years later and who has S$1 million, will get a monthly retirement income of S$2,076 – S$2,340 ^2.

Sources Of Retirement Income

A. CPF Ordinary Account (CPF OA)

CPF OA can be used to:

i. buy a home

ii. pay your monthly home mortgage loans

iii. invest in shares, bonds and unit trusts

iv. Your childrens’ university education fees.

- CPF OA balance is currently earning 2.5% interest per year.

- If you have S$20,000 in your OA and S$40,000 in your Special Account (SA), Medisave Account (MA) or Retirement Account (RA), you will get an additional interest of 1.0% per year.

B. CPF Special Account (CPF SA)

CPF SA can be used to:

i. pay your monthly home mortgage loans (special cases only);

ii. invest in shares, bonds and unit trusts.

- This account is mainly for your retirement.

- CPF SA balance is currently earning 4.0% interest per year.

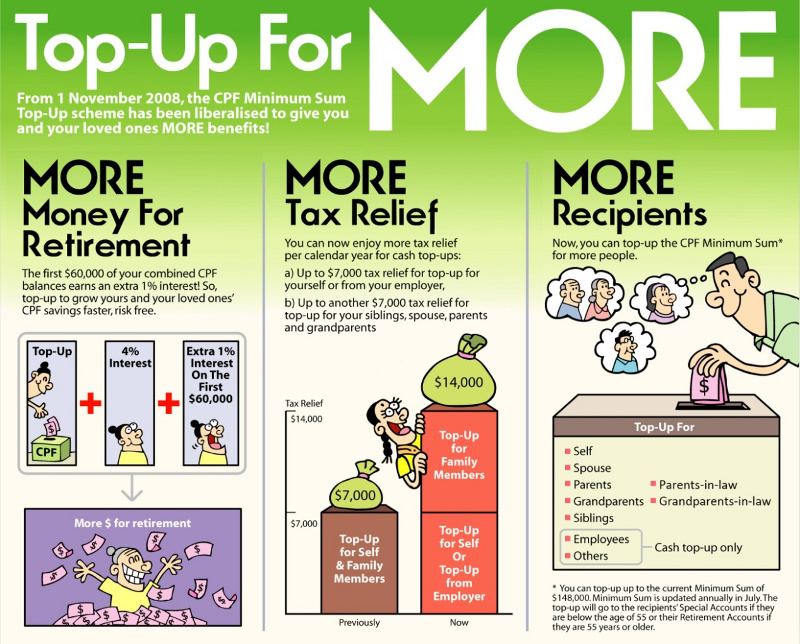

C. Minimum Sum Scheme (MSS) ^4 ^5

- *At age 55, you need to set aside monies from your CPF OA and CPF SA for your Minimum Sum Scheme (MSS).

- The MSS amount for this year 2013 is S$148,000. You need to set aside at least half of this amount from your CPF OA and CPF SA. The remaining half can be set aside using your property.

- The MSS amount will be transferred to your Retirement Account (RA) at age 55.

- RA earns 4.0% interest per year.

- Your RA amount (MSS) will be transferred to your CPF Life before age 65.

- CPF Life was started in 2009 to provide a basic annuity plan for Singaporeans, as most Singaporeans are expected to live beyond 85 years old with advancement in medical and science.

- CPF Life provides a monthly payout for life.

- CPF Life monthly payouts will start at age 65.

- CPF Life has 2 plans: LIFE Standard and LIFE Basic.

i. LIFE Standard provides a higher monthly payout but lower bequest amount to your family.

ii. LIFE Basic provides a lower monthly payout but higher bequest amount to your family.

*For the latest updates on the CPF schemes, visit the CPF official website.

D. Investments via

i. Stocks (Shares)

ii. Bonds

iii. Unit Trusts

iv. Properties

v. Endowments (Saving Plans)

vi. Jewellery, Artwork, Coins, Notes, Stamp Collections

A good financial planner will be able to help you project your CPF balance and investment value at your retirement age. In my work for my clients, I have noticed that their CPF SA works out to be a substantial amount when they retire as CPF SA balance typically accumulates faster after the age of 40. Also, I will not go into details with regard to the investment classes above as it would too lengthy.

Related: Read our Investment Series for more details on how to invest.

3. How To Achieve Your Retirement Goal

I would typically recommend using Unit Trusts and Endowments (Saving Plans) to achieve my clients’ retirement goal. These instruments require less monitoring and gives my clients a more balance portfolio (in terms of investment risk). I will not go into detail of these plans as it is quite technical.

It would be advisable to get more detailed advice from a good financial planner.

4. Start Early

I cannot emphasise more on the importance of starting early for your retirement plan.

You may be young and thinking more of maintaining your current lifestyle, but it is never too early to start planning for your retirement by setting aside some monies for either investment or endowment.

I started with a small investment plan of S$150 per month 12 years ago, investing in unit trusts, slowly increasing the monthly amount and doing cash top ups when I have spare cash. I am now sitting on a sizable sum of money, which I know will only grow further when I retire 20 years down the road. I have also set aside some monies in endowments to balance out the risk from investing in unit trusts.

As I always tell my clients, Rome was not built over-night, it took many years, much labour and material to build it. Your retirement goal may look daunting now. But more importantly, know where you are heading and take little financial steps towards achieving your goals. Everything good thing in life takes time.

And having a good financial planner to hold your hand, not literally, along the way does help to smoothen and brighten up your journey.

Remember, just like any game, Financial Planning is a game of finance. Once you know how to play it, Financial Planning can be fun!

Do you have any ideas to share on Financial Planning? Drop Winston an email at tanooisim_winston@hotmail.com.

This is the final part of our Financial planning series by Winston Tan.

References:

^1 Department of Statistics Singapore

^2 Based on reinvestment rate of 2.0% per year during retirement and inflation rate of 2.0% per year ^3.

^3 Department of Statistics Singapore

^4 CPF

^5 CPF

By Winston Tan, Chartered Financial Consultant

This article was first published in The New Age Parents e-magazine

Financial Planning For Your Family Series:

Part 1: Financial Priorities For Your Child

Part 2: Hospitalisation and Surgical Insurance

Part 3: Protecting The Golden Goose or Golden Egg?

Part 4: Planning Your Child’s Future Education

Part 5: Personal Accident Plans

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Want more comprehensive info? Check out our e-guides here.

Leave a Comment: