As we all know, it’s never too early to plan for one’s future. The untold, big-picture benefits of early financial planning are obvious, including being able to realise one’s dream retirement and not having to rely on your children for support.

That said, financial literacy does not come intuitively. Some find financial planning a daunting and complex process, whilst others simply lack the time. In fact, a 2019 OCBC survey published by The Straits Times revealed that 1 in 3 Singaporeans do not invest, with most financially unprepared for retirement or financial emergencies. The study showed that about half of Singaporeans surveyed have enough savings to last six months, while almost three-quarters are not on track with retirement plans.

Whilst these statistics may be worrying, they do remind us that a lack of planning can derail our retirement plans or leave us little for rainy days. As parents, supporting our family financially is a huge priority as well. We speak to two Singaporean parents, Draven and Charlene, on some of their fears regarding finances, how they got started on financial planning and why giving their kids a head start on financial literacy is important.

Hi Draven and Charlene! Do introduce yourself and tell us how you’re planning for your family’s future

Draven: I’m in the fund management industry, and a parent of 3 kids. I always try to save enough for the kids. The most important priority is education, so I estimate how much school fees will be needed for university in the future.

Charlene: I’m currently working in the media industry and am a mum of 3 young boys. I have to take into account my kids’ education and medical costs, emergency funds and my own retirement and medical plans. I’m also looking to grow my money to achieve my different financial goals.

As parents, what are some of your fears regarding your finances?

Draven: My greatest fear is unexpected medical expenses, as that is often unpredictable and can be really costly.

Charlene: My fears are not saving enough for retirement, my children’s education and medical costs if I were to have a serious illness. Rising education and medical costs are my biggest worries. I want to provide for my kids so they can pursue their dreams, and don’t want to be a financial burden to them in terms of medical care.

What was your experience when you first started financial planning?

Charlene: It was initially quite a complex process as there were many financial terms and tools I was not familiar with. This made making financial decisions difficult. I had to do my own research online on individual platforms, and with different banks and insurance agents.

Draven: Fortunately, I have some background in financial planning because of my work, so the process was not as intimidating because of my experience.

How have you taught your kids about financial literacy and saving money?

Draven: I set a reasonable fixed budget for my kids’ allowance. It’s important that they know to spend money in school when necessary – for example, on essentials like exercise books and stationery. I also teach them to spend only on crucial stuff if the budget is tight. I believe kids should know how to use money wisely, it being a limited resource.

Charlene: I taught them about saving, spending and purchasing decisions – specifically, how to differentiate between needs (daily necessities, food and household items) and wants (toys or expensive trips). I also teach them to manage their money by giving them a few days’ worth of pocket money for recess and imparting the concept of budgeting. Our money habits stem from a young age, so it’s important to instil the value of prudency and the discipline of managing money. I’ll be educating them on investing concepts when they are older.

“Our money habits stem from young age, so it’s important to instil the value of prudency and the discipline of managing money. I’ll be educating them on investing concepts when they are older.”

What are some money habits and values you hope to pass down to your own kids?

Draven: The foresight to set aside an appropriate amount in case there’s an urgent need. Always be ready for rainy days.

Charlene: Money isn’t the goal – it’s a tool to help you reach your goals and live your most meaningful life. Secondly, be prudent for rainy days. Also, have a minimalist mindset: there’s no need to possess too many material things, so avoid impulse buying. Lastly, to be generous and allocate a portion to those in need. I believe in serving and giving back to the community as much as we can.

Lastly, what is a financial tip you wish you’d learned sooner?

Draven: Invest early. That’s how I can afford to take more risks for potentially higher returns.

Charlene: I wish I could have learned more about the different financial and investing concepts and tools available, so that I could maximise my investments earlier.

* * * * *

A new and seamless way to give your family the financial head start they deserve.

As parents, you may be able to relate to Draven or Charlene’s experiences. Whether it’s building up a rainy-day fund or planning to grow your wealth, it’s evident that we all want to stay on top of our finances, with tools that can help actualise those goals easily. If that sounds like you, this is where apps like Autumn come in.

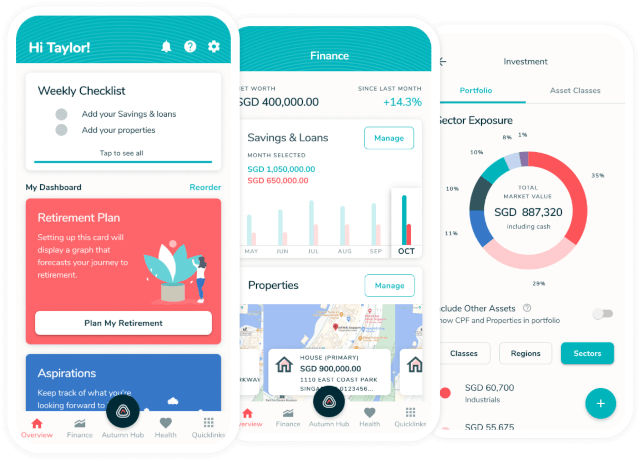

Autumn is a one-stop solution that lets you manage your family’s finances and goals – all in a single app. The way it works is simple:

- Enjoy a clear and single-view of your savings, loans, CPF, properties, insurance and investments on the Finance Dashboard. No more complex sheets or time-consuming bank statements.

- See, manage and retrieve all of your family’s insurance policies in one place via the Insurance Planner.

- Use the Aspirations Planner to visualise and prepare for your next big purchase. This useful chart helps you make informed decisions about your spending. This means you can set aside cash for a well-deserved family vacation, without sacrificing your kids’ education fund. Or decide if you can upgrade the car, and still be on track for retirement!

- Lastly, track your progress and stay accountable to your goals with the app’s Weekly Checklist.

Taking care of your family’s finances – and future – should be simple. Download the Autumn app here and kickstart your financial planning journey.

This post is brought to you by Autumn.

By Rebecca Wong.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: