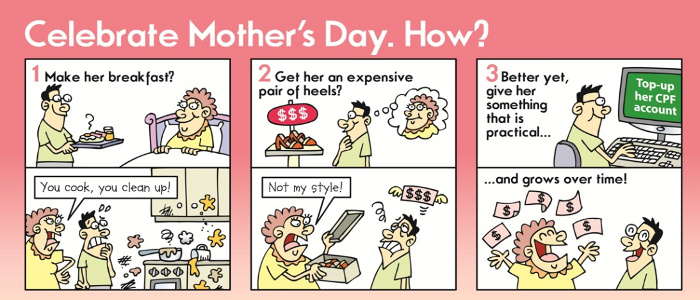

It is the time of the year again when we are having a hard time deciding what gifts we can possibly get for our mothers on Mother’s Day. Celebrated on the second Sunday of May, Mother’s Day is a celebration honouring mothers and motherhood.

As a mother yourself, you will be waiting in excitement over what thoughtful gifts you will be receiving. But don’t forget you are still a mummy’s daughter, so start thinking about what you should be getting for your mum too!

For 48 year-old Ivy Tan, who is a mother of two, she has run out of ideas on what to get for her 68 year-old mum. She hopes to get something practical for her mum this year. “My mum is no longer working. And I have heard of the Minimum Sum Topping-Up Scheme. I will most probably top up her CPF account this year since it is a practical gift that provides her with better returns through the higher interest rate. With that, she gets more than what I put in,” said Ms Tan.

According to the CPF Board, Ms Tan’s gift idea is gaining popularity. A growing number of Singaporeans are topping up their mothers’ CPF account. Last year, there were more than 18,000 top-ups from members to their mothers’ CPF account as compared to about 15,000 in 2011.

These top-ups were done via the CPF’s Minimum Sum Topping-Up Scheme (MSTU).

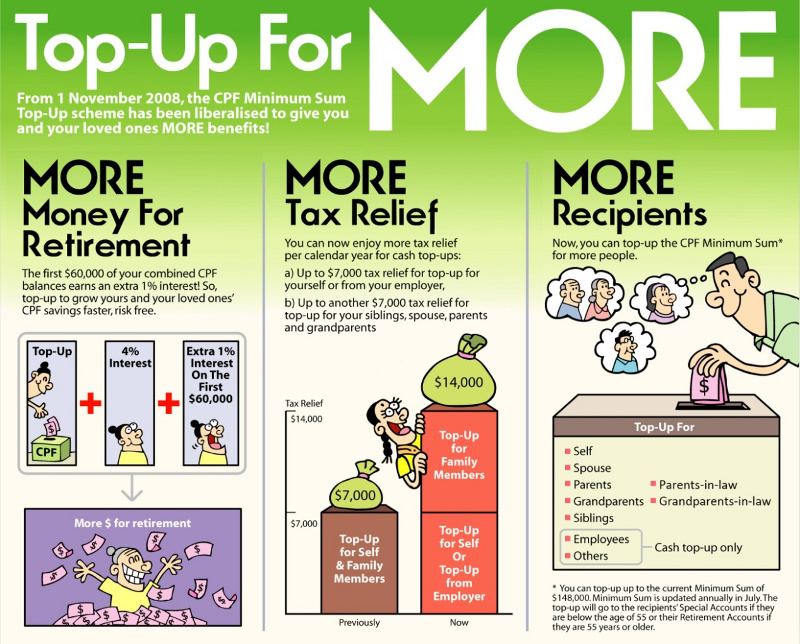

“Started in 1987, the MSTU scheme aims to help members enhance their retirement savings. CPF members can use cash or CPF savings to top up to their own CPF account or their loved ones. With the top-ups, members will have more for their retirement,” said Ms Chua Hwee Leng, Senior Deputy Director of Retirement Schemes. Under this scheme, CPF members are allowed to give top-ups to themselves or their loved ones’ Special Accounts (for recipients below 55 years old) or Retirement Accounts (for recipients 55 years old and above) up to the Minimum Sum applicable at the time of top-up, which is currently $148,000.

You can use your Ordinary Account savings to top up your mother’s CPF account. If you are below 55 years old, your combined savings in your Ordinary and Special Account, including the amount withdrawn for investments, should be more than the Minimum Sum applicable at the time of top-up. If you are 55 years old and above, the balances in your Ordinary, Special and Retirement Account, including the amount withdrawn for investment, have to be more than the amount of Minimum Sum you have to set aside at 55.

A gift that grows with time

The best part of this gift is it grows with time! The attractive interest rates as compared to what the banks are offering were certainly a draw for the members. Recipients can enjoy up to 5% interest per annum on their CPF savings and this is a bonus towards building the retirement nest egg. Currently, savings in the Special and Retirement Account earn 4% interest per annum. An additional 1% interest per annum is earned on the first $60,000 of CPF savings, with a cap of $20,000 on the Ordinary Account.

A gift that lasts for life

Do your part in helping your mother to have more during her retirement. The monthly payout¹ she will receive is $740 to $820 if she has $100,000 in her CPF Retirement Account at age 55, and has joined CPF LIFE Standard Plan. By committing more of her Retirement Account savings in CPF LIFE, she will get a higher payout when she reaches her drawdown age for as long as she lives.

A gift in which the giver gains too

As a giver, you stand to benefit too. If you are using cash to make the top-ups for your mother, you can get tax relief of up to $7,000 per calendar year. Enjoy an additional $7,000 in tax relief when you top up your own CPF account using cash. In 2013, more than 80% of top-ups were carried out using cash.

Show your mother you care by topping up her CPF account today.

¹ The monthly payouts are based on the estimated amount that the member sets aside in the Retirement Account and the L-Bonus that she is estimated to be eligible for. The payout range is based on interest rates of between 3.75% and 4.25% and does not represent the lower and upper limits of the payout. The monthly payout may be adjusted every year to take into account factors such as CPF interest rate and mortality experience. This is accurate if the member joins CPF LIFE in the month she turns 55.

This article was contributed by the Central Provident Fund Board.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Running a service or business targeted for parents? Reach out to a wider audience in our Best Enrichment Classes compilation. Leave your contact details here and we will get in touch with you.