In the second part of ‘Raising A Money-Smart Child’ E-book series, Certified Financial Planner Joanne Lai, who specialises in comprehensive financial planning, addresses the following concerns:

- What are the initial costs involved when you have a baby?

- Are you fully optimising your parenthood benefits?

Part 2: Baby Bonus Boosters

When I spoke at a workshop for first-time parents, I addressed a crowd of pregnant ladies and their husbands. But there was a lady who did not look pregnant. Curious, I asked her if her baby was at home. She replied, “I am here to find out how expensive it is for me to have a baby. If it’s too expensive then I will reconsider.”

The truth is, having a baby can be expensive. And some parents do think twice before having one. But most parents too, will come to realise that the joy of having a baby greatly outweighs the pains of bearing the financial costs. Having a child is an emotional asset, not a financial burden.

Know Your Priorities

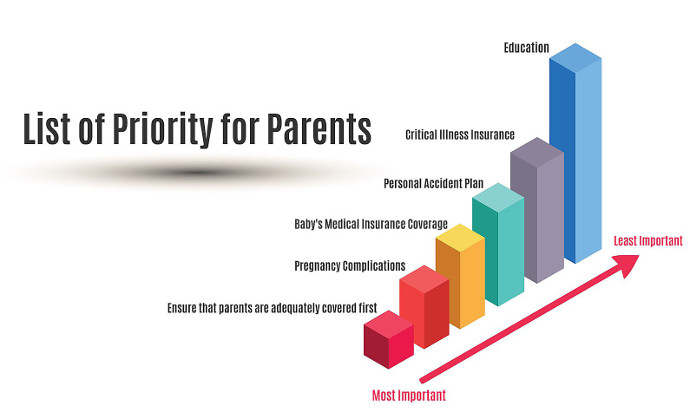

All parents want to provide the best for their babies. Some of the parents I have spoken to did not believe in insurance. However, after their baby was born, they saw the need for family financial protection. Here are important factors to note.

Image used with permission from Prezi Inc.

Image used with permission from Prezi Inc.

Priority #1: Are Both Parents Covered?

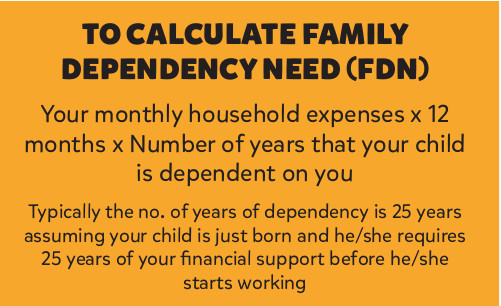

We all dislike to think of the unthinkable. But the future is uncertain. One of the first things to calculate is the sum needed for you or your spouse to tide through the growing up years of your child and yourself, should your spouse be no longer around.

One way of calculating this is to use the monthly expenses of your household as a gauge.

Most families spend approximately $1000/month on their baby’s expenses. Typically, a household will spend approximately $3,500/month for expenses, so $3,500 x 12 x 25 years= $1,050,000. A term plan that can give you the most value for money would be a good consideration.

If you are in your 20s or 30s, you can get a $1 million term plan at approximately $50/month. You can also get a critical illness plan which covers critical illnesses like cancer, stroke, heart attack and many others. I have witnessed how money has helped many families tide through the toughest periods.

The rule of thumb for critical illness coverage would be $100K + 2-3 years of your annual income. This is in the event that you lose your income and need at least 2 to 3 years to fully recover. Ideally, the payment period should be before you stop work, instead of paying for a lifetime as most people will not work throughout their lifetime.

Another important point to note is that your insurance premiums should not exceed more than 10% of your income. This is to ensure you have enough to save and invest for your children’s education, and for your retirement.

Priority #2: Pregnancy Complications

Next, you will need to think of protecting yourself, or your wife, against pregnancy complications and protecting your baby against different types of congenital conditions.

There are currently five insurers providing these plans. The coverage provided is usually approximately $5,000 or $10,000. Some parents feel that it may not be sufficient but it helps to offset some of the expenses incurred in the event of such complications.

The cost of pregnancy complications plans is usually $400 for a single premium. Some of them come with an investment-linked plan and costs approximately $100/month. It covers the baby for life insurance which can be transferred to your baby after he or she is born.

A premature baby is considered one of the congenital conditions. Sometimes, babies have to be warded at least 20 to 40 days in the hospital after they are born. The hospitalisation cost* for premature babies range from about $6,000 (government hospital) to $30,000 (private hospitals). The plans usually do not cover pre-existing conditions but they can help premature babies get life insurance immediately for critical illness coverage.

*You can only ward your premature baby into a B2 or C ward at a government hospital if you have financial constraints.

Priority #3 Is Your Baby Covered?

One of the most urgent plans you need to implement for your baby would be the “as-charged” medical plan which covers hospitalisation and surgical benefits. There are currently six insurers that can cover the medical costs of your baby for inpatient coverage which allows you to use your CPF Medisave and cash for the coverage.

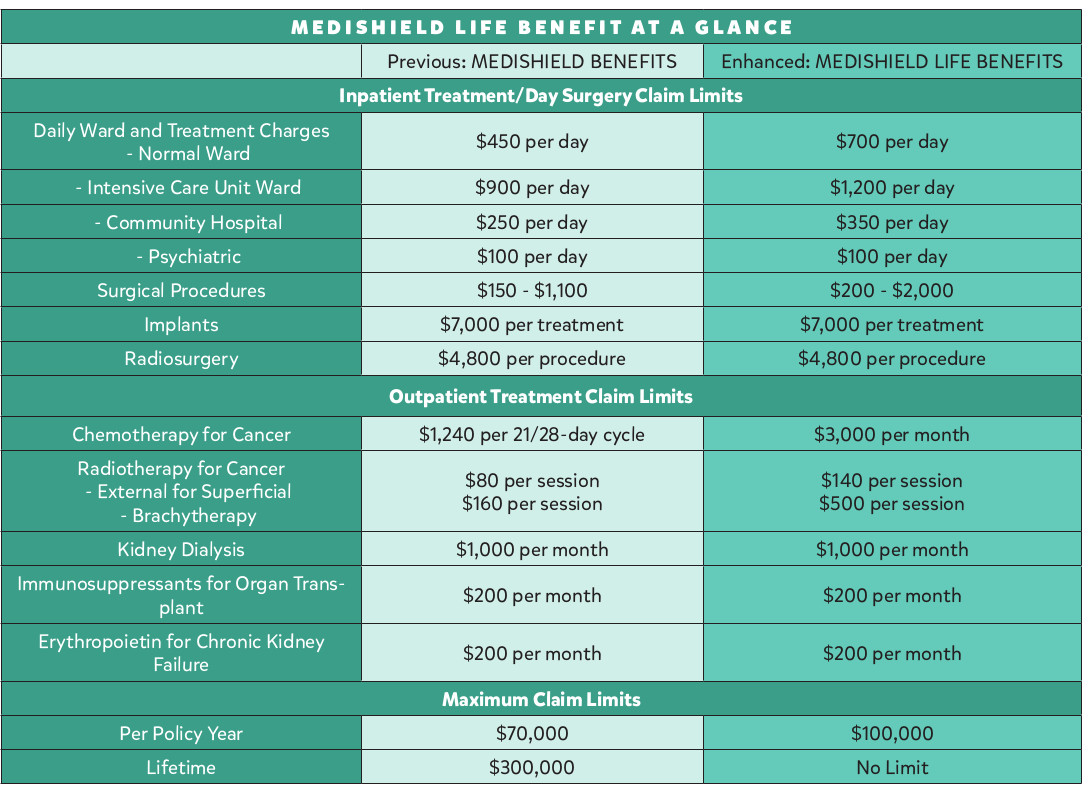

Medishield Life covers your baby for some congenital and neonatal conditions. But Medishield Life alone is not sufficient for your ongoing baby’s hospitalisation, especially for conditions like a fever in Government A wards and private hospitals. This is because Medishield is for B2 and C wards coverage only.

Based on experience, a 1 to 2 day stay at a hospital will approximately add up to $2,000 to $3,000 for Singaporeans. For foreigners, the cost can be even higher. For parents who are concerned about outpatient medical bills for their child, you can consider getting an outpatient plan to pay for your outpatient General Practioner, Specialist and Paediatrician bills. I have met couples who spent more than $10,000 in the first 3 years of the child’s life on outpatient bills.

If you are a Singaporean or a PR, you can use the CPF Medisave of your baby to pay for the “as-charged” plan. The cost is approximately $150/yr for the CPF Medisave component for private hospitalisation. The coverage ranges from $500,000 to $2 million. If you are a foreigner, you can pay using cash for a similar plan but the premiums will be higher depending on which ward you choose.

Priority #4: What Happens When Your Child Gets Into An Accident?

Young children love to explore. And they should. But sometimes, their sense of adventure can also cause them to get into accidents. Consider a personal accident and infectious diseases plan for your baby, especially when they go into childcare as the risk of getting Hand, Foot and Mouth Disease is higher.

These plans are offered free by certain insurance companies for only 6 months as the chances of having a personal accident claim in the first 6 months are not as high. The amount that you can set aside for the personal accident plan would be around $100-$200/year. Some companies have family package coverage where there is free coverage for children.

Priority #5: Critical Illness And Child Related Illnesses

A common question I get asked from parents is, “Should you buy your child’s plan now? Or wait till they are old enough to buy for themselves?” My answer is, the younger your child is when you buy the plan, the cheaper the plan will be.

Babies can be born with cancer, and cancer can develop in children during their infancy. The KK Hospital website states that 90 to 100 new cases of childhood cancers are detected in children less than 15 years old in Singapore each year. Common cancers among children include Leukaemia 35%, Brain tumour 20%, Lymphoma 10%, Eye tumour 7% and Kidney tumour 6%.

A friend was diagnosed with cancer at the age of 16, had a relapse at 18, and had the third relapse while in university. Her parents did not get any insurance for her and she chalked up a lot of medical bills. After she started working, she had to spend all her savings on paying the bills for 5 years after her graduation, before she could start saving her own money.

If you have budget constraints, a term plan would be more affordable for the next 20 years or until the child starts working. If you can afford approximately $100+/month and above for a $200 – $250K coverage, a limited whole life plan would be ideal as the payment term is only 20-25 years and coverage is for a lifetime.

For parents concerned about child related illnesses, there are insurers who can cover the following conditions within the life insurance plans for a greater peace of mind.

- Severe Juvenile Rheumatoid Arthritis (Stills Disease)

- Severe Haemophilia

- Rheumatic Fever with Valvular Impairment

- Osteogenesis Imperfecta

- Insulin Dependent Diabetes Mellitus

- Kawasaki Disease

- Glomerulonephritis with Nephrotic Syndrome

- Type 1 Juvenile Spinal Amyotrophy

Priority #6: Your Child’s Education

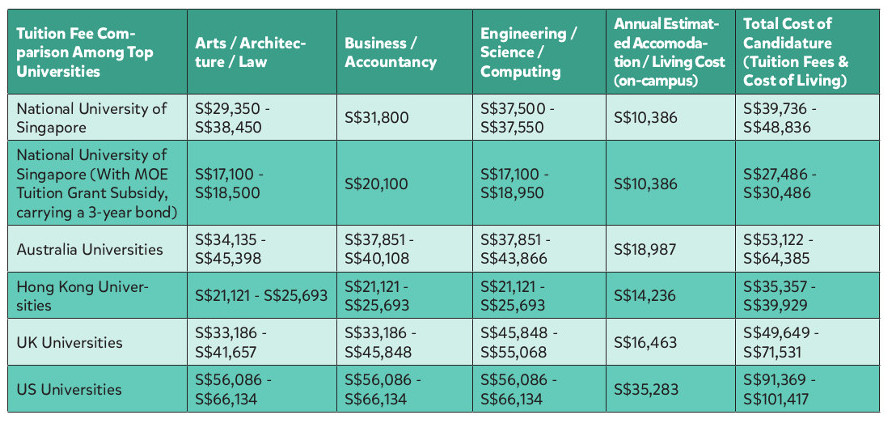

Once the health and protection issues are addressed, the next thing parents would be most anxious about is – education.

One of my clients was diagnosed with cancer and all the savings plans for her daughter’s education were fully waived so she could focus on her recovery. Her daughter would still be able to have her education fees.

** 2016 Annual Tuition Fees

Source

For people who prefer guaranteed returns, an option to consider for your child’s education is an endowment plan. Generally, the returns would be 3 – 4% per annum and there are plans that only require payment for 5 to 15 years. The plan is fully paid until the child enters university at age 21 for boys and 19 for girls. If you prefer investments for your child’s education, you can get typical returns of 6 – 9%.

During my growing up years, my mother was most concerned about whether I could do well enough to get into a local university. She started an endowment plan as she was very risk-averse and wanted to set aside a portion of her monthly income for our education fees in the university.

If you know how to invest well, your returns could be 15% per annum or more. Some of the investments would be collective investments such as funds, ETFs, stocks and shares or even properties.

To determine which investments are most suitable for you, you need to consider your own risk profile, time frame, liquidity, together with your acumen in investing. If you prefer more passive investing, then you can go for indices or dollar cost averaging into collective investments.

If you prefer active management, there are portfolios to help you monitor your investments for you using a trusted and proven system or you can do your own research and pick a basket of undervalued stocks.

This is the second part of our E-book series: How To Raise A Money-Smart Child. You can download Part 2 of this E-book here.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.