The fear of uncertainty is increasing as our economic standing is getting worse. Every time you turn on the television or read a newspaper you are bombarded with more depressing news about the downturn of the economy.

With a recession looming over our heads, many families are faced with the loss of their jobs, homes, and vehicles. This type of dark cloud hovering over our heads causes unnecessary stress, depression, and uncertainty.

In today’s society, standard living necessities are much higher than in earlier years. Maintaining this type of lifestyle increases the amount of stress brought onto a family. It is only natural that you hope that everything works out, your emotional stability is still altered.

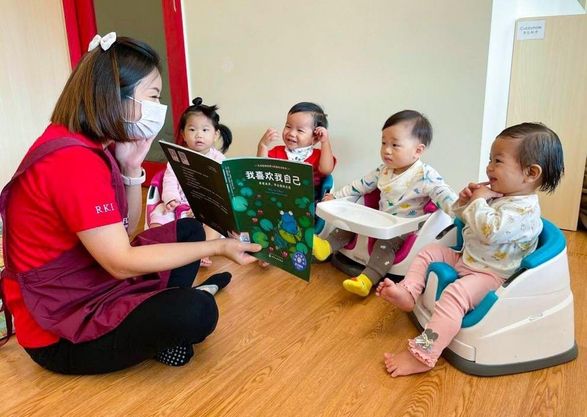

Unfortunately, this stress is easily visible to children and transfers down to them. The uncertainty of such times affects the entire family, not just the breadwinner.

Even in such tough times, there are some ways to protect your family from the effects of a recession, also known as recession-proof your family. Below we are going to discuss some of the things you can do, as a family, to protect and prepare yourselves for an economic downfall.

Spell out the entire / current situation to the whole family. The only way to do this properly is to have everyone – in the family – sit down together with no interruptions (i.e. television, mobile phones, laptops, iphones, ipads etc). Discuss what is going on and how it will affect the family – as a whole. (Do NOT hide anything here – this is crucial.) Discuss what cutbacks or changes the family is going to have to make – together – to make things work.

Get the entire family to participate in ideas and family activities that will keep you bonded and active. Some great examples are watching a movie – at home – on a Friday night rather than going to the movies. Have a picnic at the local park rather than a fast-food restaurant. Go for walks around the neighbourhood, it gets you out of the house and is good for you.

Whatever you do, make it clear that this is a rough time but that you will make it through if everyone works together.

It doesn’t matter how much you make; it’s how much you spend or save. Every family brings in a different amount of money. Some families, with the least amount of income, are happier than those families with a large income. It’s about surviving and being happy with what you have, not with what you could have or keeping up with what your neighbours have.

Plan, as a family, how you would live on a smaller income if necessary. Shop at different stores, start collecting coupons (and actually using them), shop at the stores that are having sales, or stop spending excess money on unnecessary items like gourmet coffee (this can be made at home).

If you, and your family, take a look at where you are spending your money and eliminate the unnecessary items, you would be amazed at how much money you could save!

Make friends with like-minded, frugal people. Hanging out with people who are not dealing with the negative effects of the economy is more harmful than beneficial. Find families, and friends, who are in the same position, who are trying to save a buck wherever they can. Making a network of families who are all in the same boat, gives your entire family the confidence to move forward, and lessens the chances of depression and negative thoughts. This gives you more people to work with and hang out with and less of a chance to see the negative effects of an economy that is falling apart.

Count your blessings. One of the most important aspects of a situation like this is to look at the good stuff. Remember to be grateful for what you do have, and be happy that you are given another day to enjoy life. (Do NOT focus on the negative!)

Vehicles, for example. Their one and only purpose are to get you from point A to point B. Is there any point in purchasing a brand new car when the one you have gets the job done? There is not – at least you have a car!

Do you really need to take a trip to Europe? Why not travel to Asian countries instead? What about all of the new gadgets and toys on the market? Do you really need your house full of them? If you already have a mobile phone that works, why spend hundreds of dollars on the latest release?

Learn to be content with what you have; materialistic items do not make you happy!

Let go of your pride. This one is tough, there is no doubt about it. Learn to appreciate clearance racks, second-hand stores, and generic brand foods. There is absolutely nothing wrong with purchasing these items!

My sister and I shop at neighborhood shops near our mum’s place. We can usually find what we are looking for and are happy with our purchases.

The money you save, by shopping in this manner, can be put aside for a weekend getaway, a big family purchase, some sort of reward money to praise your family for becoming frugal.

Save for rainy days. Remember the days before you had kids, where you could take long holidays for 3 weeks to Australia or New Zealand? Or buy all of the latest electronic gadgets on the market?

Your family and children are worth more than any of that combined! Whenever we have extra money, it goes away for children’s education or for those inevitable rainy days.

A great example is, before I had kids, I used to go shopping at least once a month. Now that I am a stay at home mom, I have chosen to put that money aside. Surprisingly, maybe to some, I wouldn’t change it for the world!

Cut down on the “negotiables”. If you have any debt, get it paid off. Stop buying the extras, and use that money towards your debt. The quicker you pay this off, the quicker you will be back on your feet and doing well.

What are the extras? Movies, cable, phone bills, anything that you do not NEED to live. Extras are the things you want but can definitely survive without.

Managing your expenses gives you better control on your finances. Getting control, before anything drastic happens, gives you a solid foundation just in case you lose your job or you take a pay cut.

Learn a new skill. Any skills that you have, keep them up to date and continually add to your skillset. The more skills you have, and the more up to date that they are, the more needed you become!

Start looking into home or side business opportunities, ones that allow you to use your skills and talents. Having an extra income, on the side, will help if anything were to happen.

Many people are not good with computers, which eliminates many of today’s “work from home” programs. However, if you have a skill in sewing, cooking, or even baking, you can find a side job.

Be creative, think of ways that your skills can be used to help add to your current income.

In conclusion, live your life to its fullest! Get control of your financial situation. Build a strong bond with your family. Find common grounds where everyone can help keep your family together. Enjoy each other!

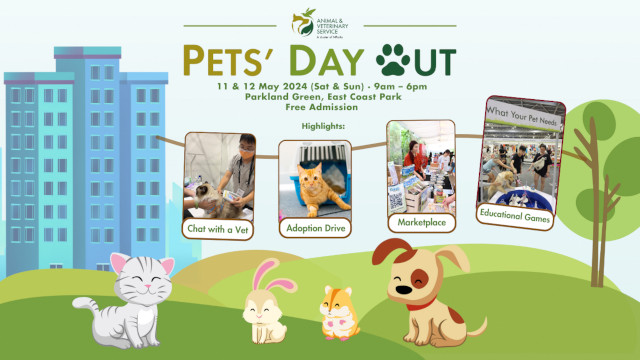

There are many opportunities out there, which can help bring in additional income. Kids can babysit, mow lawns, water plants, use your skills! Take control of your financial situation NOW, before something happens, protect yourself and your family!

This article was first published in The New Age Parents online magazine.

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Leave a Comment: