Singapore Health Facts

You may have heard of the saying: “One can pass on in Singapore, but one cannot be sick with illness or hospitalised in Singapore”. This saying could not be more right.

Singapore is one of the fastest aging society where 1 out of 4 persons will be more than the age of 65 as at year 2030^1. Coupled with an increasing average mortality age (82.0 as at 2011^2), Singaporeans are living longer. Healthcare costs are becoming an increasing concern and priority among our sandwiched generation.

Singapore is one of the fastest aging society where 1 out of 4 persons will be more than the age of 65 as at year 2030^1. Coupled with an increasing average mortality age (82.0 as at 2011^2), Singaporeans are living longer. Healthcare costs are becoming an increasing concern and priority among our sandwiched generation.

As at 2011, a stay in a public / restructured hospital costs an average of S$995 to S$11,924, depending on the hospital one stays in^3.

A surgery in a public / restructured hospital will set you back a further average of S$1,151 to S$22,943^3. And the HealthCare Cost Price Index had increased by 4.3% since 2009 (as at the year 2011)^4.

Medisave, Medishield, Private Integrated Shield Plans & Cash Riders. What’s the difference? I am so confused!

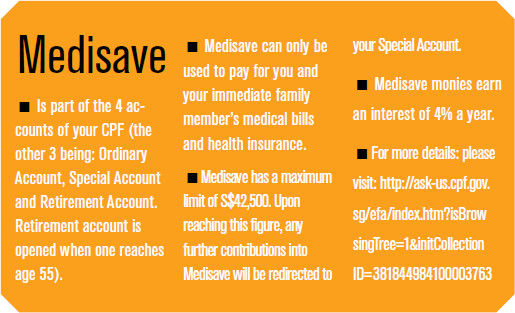

Many people may be confused by the above “jargons” and what it all really means, here is a brief description of the terms.

Medishield

- Is introduced in 1990 and is a low cost basic health insurance scheme that covers a portion of a person’s hospitalisation and surgical bill.

- Operated by the CPF Board.

- More suited for one who opts for Ward B2 or C.

- Can use Medisave account to pay premiums.

- Has co-payment features consisting of deductibles (up to S$3,000 per policy year) and co-insurance of 10% to 15%.

- All working Singaporeans (including newborns from year 2011 onwards) are automatically covered under Medishield unless you choose to opt out.

- For a more detailed list of coverage under Medishield Life, click here

Private Integrated Shield Plans

- Are enhanced “versions” of Medishield with additional benefits and coverage.

- Are operated by the private insurers, namely AIA, Aviva, Great Eastern, Income and Prudential.

- Suited for one who opts for Ward A or B1.

- Can use up to a maximum of S$800, S$1,000 or S$1,200 per year per policy (different maximum for different age groups) from your Medisave to pay for premiums.

- Also have co-payment features consisting of deductibles (up to S$3,500 per policy year) and co-insurance of 10%.

- Each person can only choose one health insurance in Singapore.

- For a more detailed list of coverage for private integrated shield plans, click here

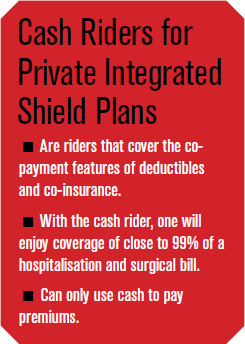

Important notes on Health Insurance

- Provides coverage of up to 99% of a person’s hospitalisation and surgical bill.

- Professional advice is to switch to a private integrated shield plan (as charged plans) as Medishield is only a basic plan that has maximum limits in its benefit categories.

- Health Insurance also covers outpatient treatments like approved cancer and renal dialysis treatments.

- If one only buys a basic health insurance (i.e. private integrated shield plans), it is an equivalent of one carrying an umbrella with holes on a rainy day.

- Hence, it only makes sense for one to buy a complete umbrella for a rainy day (i.e. private integrated shield plans + cash riders).

- Providing a peace of mind for one and their family.

What to look out for in Private Integrated Shield Plans

The benefits of Private Integrated Shield plans between the insurers are more or less similar. The only differences are the few benefits that other insurers do not provide.

For a more comprehensive view of the differences, you may want to look at the comparison table provided by Ministry Of Health.

Also, one needs to understand that health insurance is always improving and changing (thankfully for the better). Over the years, health insurance had become more comprehensive and the coverage amounts had increased. But does it mean that whenever one insurer’s plan has improved and is better than the others, it is time to switch to that “best” plan?

My professional advice is please do not do that, for the following reasons:

- If one has claimed before on his health insurance or his/her health condition has changed over the years, it is advisable not to switch to a new insurer. As the new insurer will most likely impose limits or exclusions on the health condition(s).

- Since it’s a never-ending process of improvements and changes to each insurer’s health insurance, one plan can never be the best for long.

- Instead, focus on choosing an adviser that can serve your financial planning needs in the long run.

- Check the different insurer’s policies and clauses on yearly renewals (for yourself and your children), pre-existing conditions, waiting period and survival period (if any). Do note that not all medications (especially cancer medications) are covered under your hospitalisation and surgical insurance.

Hence, the importance of Critical Illness plans where it pays out a lump sum to help in defraying your medication and daily living costs (while you are recuperating). I will cover this in more detail in my future article on Critical Illness planning.

The purpose of insurance is to allow you to have a peace of mind and making sure that your plan pays out when you need it the most, and at the fastest time. Claim turnaround time is also an important factor when you are considering a health insurance.

You may visit MOH website and take note of the claims return rate of the different insurers.

After everything that is said on the what-ifs of health insurance, please also remember the old adage of being happy, keeping a positive mental attitude, lots of water and fibre and exercise!

If you take good care of your health, your body will take good care of you!

References:

^1 http://www.scribd.com/doc/41225405/Briefing-Paper-Ageing-Population-in-Singapore

^2 http://www.singstat.gov.sg

^3 www.moh.gov.sg/content/moh_web/home/costs_and_financing/schemes_subsidies/medisave.html

^4 www.moh.gov.sg/content/moh_web/home/costs_and_financing/schemes_subsidies/medisave.html

By Winston Tan, Chartered Financial Consultant

This article was first published in The New Age Parents e-magazine

Financial Planning For Your Family Series:

Part 1: Financial Priorities For Your Child

Part 3: Protecting The Golden Goose or Golden Egg?

Part 4: Planning Your Child’s Future Education

Part 5: Personal Accident Plans

Part 6: Planning For Your Retirement

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Want more comprehensive info? Check out our e-guides here.

Leave a Comment: