POSB will be offering parents an interest rate of 2% p.a. for the entire duration of their Child Development Accounts (CDAs) opened with the bank. This is believed to the highest interest rate accorded by a bank on CDAs in Singapore.

➡️ Related Read: Difference Between Baby and CDA

Singapore’s first Jubilee baby Chloe Tham, and her parents, Keith Tham and Daphne Lian with Jeremy Soo, Head of Consumer Banking Group (Singapore) at the launch.

Singapore’s first Jubilee baby Chloe Tham, and her parents, Keith Tham and Daphne Lian with Jeremy Soo, Head of Consumer Banking Group (Singapore) at the launch.

TNAP answers some of the questions you may have about POSB CDA benefits.

When will I be able to enjoy this interest rate?

When you open your CDAs with POSB from 13 July 2015 onwards.

Is this applicable to all my children?

The interest rate will apply to your first and second child, up to a maximum of SGD12,000. For your third and fourth child, it will be up to a maximum of SGD 24,000 while the limit for their fifth child and beyond is SGD 36,000. This interest rate will be available to all new CDAs opened with POSB, including CDAs that parents choose to switch from other banks.

What do I have to do?

Simple! All you have to do is to apply or switch to the “POSB Smiley CDA” at the MSF Baby Bonus Online Portal.

PERK: Receive A Smiley Gold Bar and Baby Bonus NETS Card!

To help parents save for their children’s future, a joint POSBkids account will be provided as an option to parents with the opening of a POSB Smiley CDA. While you start to plan for your children’s university education, the bank will also be giving away a special edition “Smiley Gold Bar” for the first 1,000 parents who sign up for any of DBS/POSB’s education savings plans. Children will also be able to enjoy comprehensive insurance coverage when they take up POSB Kids Care, a personal accident protection plan with over SGD100,000 coverage.

Parents will also receive a POSB Baby Bonus NETS Card where they can get to enjoy discounts and privileges at various online, retail and dining merchant partners like Mothercare, My Gym, VitaKids, etc. Parents will be able to use the card to pay for their childcare and medical expenses at Approved Institutions (AIs) registered with the Ministry of Social and Family Development.

What am I entitled to in the POSB Smiley CDA?

- 2% p.a. interest on their POSB Smiley CDA for the entire duration they are with the bank

- Discounts and privileges with POSB Baby Bonus NETS Cards

- Free Smiley Play Tent with every POSBkids account opened

- Special edition Smiley Gold Bar for the first 1,000 parents who sign up for any of the bank’s education savings plans

- Personal accident protection with POSB Kids Care with over SGD 100,000 in coverage

- Benefits at over 1,500 merchants with PAssion POSB Debit Card and daily savings with DBS/POSB credit/debit cards

- SGD 10 rebate into DBS PayLah! for online purchases on Qoo10, until September 2015

Other POSB Initiatives and Incentives

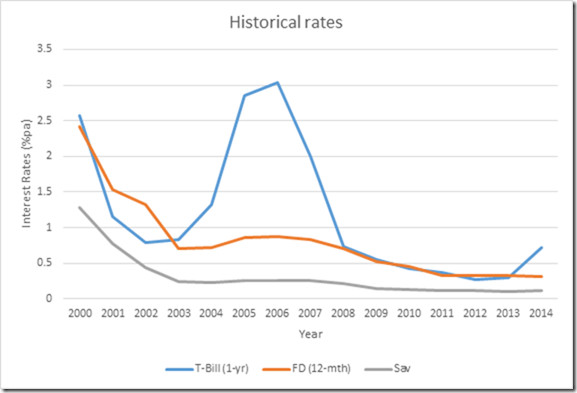

In October last year, DBS/POSB offered parents an additional 1% p.a. interest rate for six months on every CDA registered with the bank from 3 October to 31 October 2014. The bonus interest will be credited once the CDA is opened with the bank.

In December 2014, POSB announced that all babies born in 2015 would receive a limited edition “POSB Smiley Gift Bag” from the bank. This was one of DBS/POSB’s SG50 initiatives to give back to the community as Singapore prepares to celebrate its 50th birthday next month. Since then, over 20,000 gift bags have since been given away.

In January this year, POSB relaunched the popular POSB National School Savings Campaign which has garnered strong support from the community and has achieved 100% participation from all primary schools in Singapore.

Photo credit: DBS Media Centre.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: