With my previous articles on the different types of investment classes, investment products, and investment styles, you should now have a clearer picture of investing. Before you embark on the investing route, here is a checklist of things to be aware and clear of.

⇒ Related Read: 3 Important Things To Consider Before You Invest

1. Understanding Your Risk Profile

Risk Profile is also known as Risk Tolerance. It is defined as an evaluation of your willingness to take risks. Simply put, if one is not able to take much risk (or downside, also known as possible loss) in their investment, they are considered a Low Risk profile. Risk profile is normally divided into 4 categories: Low, Low-Medium, Medium-High, High.

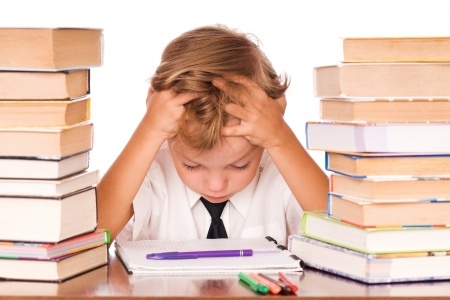

It is very important to understand your own risk profile before taking up any investments. Which is why this is the first on my checklist in this article. Some clients whom I have worked with, who believe they are low risk takers, expect very high returns with low risks. This is not possible in investing, as high returns demand a higher risk tolerance or downside.

Risks however can be mitigated via the Investment Efficient Frontier. I will not be going into further details on Efficient Frontier within this article as it is quite technical. You may like to search for this term on the internet for more details.

Risk Profile and Investments

Knowing one’s Risk Profile would also decide on what type of investments they should invest in. For instance, a low risk taker should buy more bonds in their portfolio (between 70% to 80%). Whereas a high risk taker should have 70% – 80% in equities.

One may find their risk profile via a series of questions on their attitudes when it comes to investing. The answers are tabulated to a score, with corresponding scores tied to different risk profiles.

These risk profiling questions are normally available from a professional financial planner or one may find it online. One thing to be wary of online risk profiling questions is some questions may not fit into our local context. Also, do make sure that you answer at least 8 – 10 questions to have a more accurate score.

2. Investment Time Horizon

One’s investment timeframe is also a crucial element in their investment portfolio and indirectly, affecting their risk profile.

A person who needs his investment monies in 5 or 10 years is normally recommended to reduce his risky investments to a more low-medium risk portfolio.

Contrast that with a young person who is investing for his retirement funds he needs in 30 years, he may take on a more aggressive portfolio with more equities for the long term, that is if he can stomach the downside risk of the portfolio.

Time horizon is definitely one of the questions for Risk Profiling.

A professional financial planner is able to assist you in constructing a suitable portfolio(s) by taking into account your Risk Profile and Investment Timeframe.

3. Charges

For any kind of investments, be it bonds, equities, funds from fund houses, there are costs and charges involved. Do make it a point to ask for all charges. Here are a few types of charges one should look out for:

- Initial Investment Charge

- Admin Charge (to maintain your investments)

- Bid-Offer Spread

- Fund Management Fee (for fund managers)

- Investment Withdrawal Charge

- Brokerage Fees

- Fund Switching Fees

In general, if your investment involves active management from a third party, e.g. Fund Managers in an active Worldwide Equity Fund, the annual investment charge is slightly higher compared to a Fund Manager specialising in Asia Bonds.

4. Rebalancing your Portfolio

Over time, some asset classes in your investments may outperform others. For instance, if one is a High Risk Profile and investing in 75% in equities and 25% in bonds. Overtime, his portfolio had become 85% in equities and 15% in bonds, he is taking on additional risks than he should be. He should rebalance his portfolio by selling 10% of his portfolio in equities and reinvesting them in bonds.

This rebalancing is important in the long run as it eliminates emotional buying or selling by introducing a systematic way to maintain your portfolio. Also, rebalancing achieves an indirect effect by selling high and buying low.

5. Financial Planning Priorities

Before investing be sure that you have already set aside the following:

- Emergency Fund of at least 6 – 12 months of your living expenses

- Purchased your own personal Hospitalisation & Surgical Insurance.

- Have set aside a substantial amount of insurance to cover your living expenses should Critical Illness or Disability occur. These events prevent you from earning monies, disrupt your wealth accumulation and drain your savings. Make sure you know how much you need to set aside for these events.

- Have set aside a substantial amount of insurance for your spouse and family should you decide to take a “long-holiday” without returning. This money should be able to cover the living expenses of your family and education fees of your children.

- Have set aside your children’s education funds.

- Investing monies should be spare sources of your funds, and not monies that you will need for emergency purposes or in the short term. Investments may not generate any meaningful returns in 2 – 5 years. Investing should be seen as for the long term of at least 10 years and not short term speculation.

6. Sticking To Your Investment Strategy

Investing strategies like, for instance, what are you going to invest in for the long term? And how is your portfolio constructed? What are the times when you should rebalance or readjust your portfolio?

Do not be affected by short term news (some called it noise) and stick to your long term strategy of investing and you will have a higher chance of having good returns over the long run.

With the knowledge I have shared over the past one year, I believe you are more confident when it comes to investing. When in doubt, please do consult a professional for advice. With the knowledge you had read and now possess, you would know what to expect and the relevant questions to ask.

If you decide to engage a financial planner for your investment, he or she should be more than competent to do more than a risk profile and constructing a suitable portfolio for you. The adviser’s after-investment support is equally important. I provide my investment clients a quarterly update on their investment performance, be it the performances are in the black or red and will let them know when it is time to do a rebalance of their portfolio.

And do ask your financial planner what are the benchmarks and thresholds to sell, buy or rebalance. It will also be great if your financial planner has an investment philosophy to share with you.

Thank you for having me in the past one year. I hope all readers had benefited from my sharing. Please do contact me if you have any queries.

For queries, please do email Winston at tanooisim_winston@hotmail.com.

This article was first published in The New Age Parents e-magazine.

How To Invest And Grow Your Money Series:

Part 1: Important Things To Consider

Part 2: Investment Basics 101

Part 3: Different Investment Styles

Part 4: Important Indicators To Look

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Leave a Comment: