So you have decided what you want to invest in, set aside spare funds and equipped with the basics of investing. What’s next? Should you invest to build your portfolio? Which funds, stocks to choose? How much should you invest in bonds, equities, exotic investments? All these questions point to one thing – investment styles. Here are five different investment styles to consider.

1. Active vs Passive Management

An active management style means actively selecting the stocks in the portfolio. Actively managed unit trust funds typically have a full time staff of financial researchers and portfolio managers who are constantly seeking to gain larger returns for investors. This style typically incurs higher investment expenses.

Passively managed investors argue that many passive investments, over the long term (some empirical evidence suggests), outperform actively managed investments. Passively managed unit trust funds, which do not require researchers, typically have a lower investment expense.

2. Growth vs Value Investing

After deciding between actively or passively managing your portfolio, the next question would be: growth investing or value investing?

Growth investing looks for companies or stocks that have high earnings growth rates, high return on equity, high profit margins and low dividend yields. These companies are often innovators in their industries and making lots of money (quickly). These companies typically reinvest most or all of their earnings to fuel their continued growth in the future (thus a lower dividend yield, as they are reinvesting the profits back into their own companies for more growth).

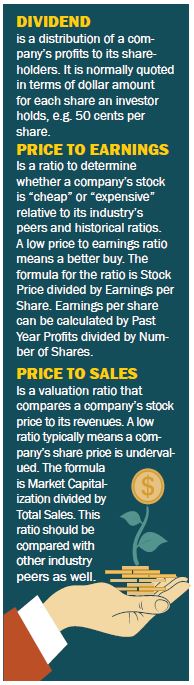

Value investing focuses on buying strong companies’ stock at a good price. Thus, we should look for low price to earnings ratio, low price to sales ratio and a higher dividend yield. Warren Buffet is a well-known proponent of Value Investing. He once said, “I’m 85% Benjamin Graham.” Graham is the godfather of value investing and introduced the idea of intrinsic value, the underlying fair value of a stock based on its future earning power. To understand more about the way Buffet invests, you may read this article at Investopedia.

3. Small Cap vs Large Cap Companies

After deciding the investment style from the above, next will be deciding if you should invest in small or large cap companies.

Some investors like small cap companies for their potential to deliver better returns as they have more room for growth and are more adaptable to change. However, these potential for greater returns also equal higher investment risk. Also, the share prices of small cap companies are typically low but more volatile.

Large cap stocks are more suited for more risk-averse investors. They prefer these companies for their stability and size. Investors should expect lower returns, less risk and a higher but more stable share price. Large cap stocks are also sometimes referred to as Blue Chips.

4. Asset Allocation

This style dictates that a certain percentage of your investment portfolio must go to 3 asset classes: equities, bonds and cash equivalents over the long term to achieve a desired return. The portfolio asset classes (i.e. equities, bonds and cash) differ between different risk appetites. Lower risk investors will be asked to invest more in bonds, less in equities, and vice-versa for higher risk investors.

Proponents for this style quote that this style can provide stable long term returns.

This style is further subdivided to Strategic and Tactical Asset Allocation.

Strategic Asset Allocation is to take up a fixed-percentage of asset classes, based on your risk appetite and re-balancing your portfolio when some asset classes are outperforming others. Strategic Asset Allocation is also a Passive Investment Style, i.e. “Buy and Hold”.

Tactical Asset Allocation is to allow for a range of percentages in your different asset classes, e.g. 40% – 50% in bonds. This style allows a small amount of market timing, since the investor can easily invest more of an asset class to maximise the asset class’ upper range of the allowable percentage if he feels that asset class is “cheap”.

5. Dollar Cost Averaging

Dollar Cost Averaging, is an investment strategy, that says you should invest in unit trusts or stocks of your choice on a fixed regular basis, e.g. monthly, quarterly, half-yearly or yearly, so as to maximise the upward and downward trend of the investment market. Since investors will never know whether the price is high or low when they invest, this method works best to quell these fears.

The best form of Dollar Cost Averaging is daily! But in reality, daily averaging will not work. Fund management houses and stock exchanges will probably give the investor a weird chuckle if you ask them to invest daily. Reasons being high administrative costs, high entry to invest (fund houses will typically require you to invest at least S$1,000 per transaction). One can buy shares on a daily basis, but typically it will be restricted to low cap stocks with low share prices, in the long run, this may be detrimental to that investor’s overall investment portfolio.

Hence, the next best form of Dollar Cost Averaging is monthly, which is why most fund management houses have a monthly investment plan available for retail investors.

Wrapping Up

Some clients have asked me, so which style is the best? There is no one best investment style in the world. If there is, everyone in the world will be following that style, and fund managers and I will be out of business. Every individual is unique with a different risk appetite. Choose a style that suits you most, tweak it accordingly if it’s not working and stick to it. In fact, some of my clients even choose a mixture of styles – e.g. invest in more big cap companies and a few small cap companies or vice versa.

Some clients have asked me, so which style is the best? There is no one best investment style in the world. If there is, everyone in the world will be following that style, and fund managers and I will be out of business. Every individual is unique with a different risk appetite. Choose a style that suits you most, tweak it accordingly if it’s not working and stick to it. In fact, some of my clients even choose a mixture of styles – e.g. invest in more big cap companies and a few small cap companies or vice versa.

And I would like to reiterate that investment and speculation are two different things.

Investment is defined as a monetary asset purchased with the idea that the asset will provide income in the future or appreciate and be sold at a higher price. Hence, investing is for the medium (5 – 10 years) to long term (more than 10 years). My advice for my clients typically is to invest for more than 10 years.

Speculation is typically for short term, typically less than a year, and is defined as an act of trading in an asset that has a significant risk of losing most or all of the initial capital, in expectation of a substantial gain. Speculation typically has no long term strategy.

Most importantly, seek a professional financial planner’s advice. They will be able to guide you through the investment styles and find one that suits you the most.

By Tan Ooi Sim Winston, Chartered Financial Consultant

Got a question? Email Winston at tanooisim_winston@hotmail.com.

This article was first published in The New Age Parents e-magazine

How To Invest And Grow Your Money Series:

Part 1: Important Things To Consider

Part 2: Investment Basics 101

Part 4: Important Indicators To Look Out

Part 5: Important Facts To Know Before Investing

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Want more comprehensive info? Check out our e-guides here.

Leave a Comment: