Stay-at-home mums (SAHM) leave their careers to raise their children and care for their parents or elderly relatives. Without a regular income, how can SAHMs plan for retirement?

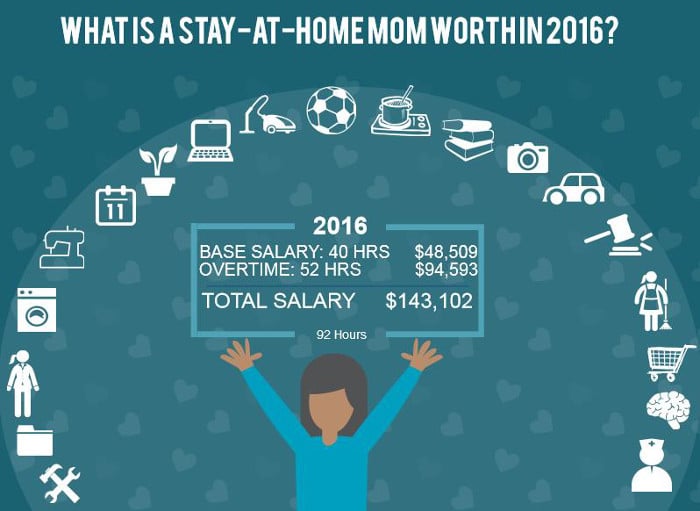

The worth of a SAHM has been estimated by FamilyTime to be $143,102 a month in 2016.

Image source: Family Time

You may or may not agree with this assessment, but we all know that SAHM is unpaid for their time and commitment to their families, and rely on the incomes and financial resources of their loved ones.

Living on a single income can be harrowing as it is almost like putting all your eggs in one basket i.e. your husband. Without any income of their own, how can SAHMs plan for retirement at all?

But Who Is Speaking Up For Stay-At-Home-Mums?

One person who has been constantly raising the issues that SAHMs face is NTUC Assistant Secretary-General Patrick Tay.

In 2014, he highlighted in a Parliament speech on how there is a lack of societal and governmental understanding of the critical role SAHMs play in supporting the family.

He urged the government to give targeted support to SAHMs by:

- giving maternity leave for those expecting their second child or more

- transport subsidies as SAHMs have to bring their children along while running errands

- extending tax reliefs and rebates to SAHMs

- help SAHMs plan for retirement by topping up their Medisave and Special Accounts

- having work re-entry programmes for SAHMs with older children to return to the workforce

Are There Targeted Measures To Help Stay-At-Home Mums with Retirement?

The latest amendments to the Child Develop Co-Savings Act (CDCA) announced on 10 November 2016 included more help to unwed mums, working fathers and adoptive parents.

However, there still aren’t any specific government measures targeted at helping SAHMs.

Patrick Tay, whose wife is also a SAHM, reiterated his call again on the same day to ask the government to make it a priority to provide support for SAHMs for retirement.

Image source: Patrick Tay Facebook

1. Helping back-to-work SAHMs find suitable jobs

If SAHMs choose to go back to work, Mr Tay suggests the government could consider creating a SAHM “Returnship Programme” spanning 4 to 6 months to facilitate the matching of women jobseekers and employers.

A SAHM will be given guidance and training to update her skills, better understand the job and ascertain her suitability for the position.

If she successfully completes the Returnship Programme she can embark on the existing Professional Conversion Programme for further training to make the career switch.

2. CPF Top Ups

Currently, husbands (or children) who top up the CPF accounts of SAHMs can get CPF Cash Top Up Relief. Mr Tay is asking if the government can also regularly top up the CPF accounts of SAHMs directly.

3. Support for SAHMs who engage in part-time, temporary or freelance jobs

There are some SAHMs who work part-time, temporary or freelance jobs to earn some money to get by, but who lose out on Workfare scheme as they are younger than 35 years old, or their husbands earn higher than $70,000 assessable income.

Mr Tay asked if these SAHMs would be entitled to cash supplement, CPF contributions and training grant too, to encourage SAHMs to stay in connection with the job market and keep their skills updated to that they can easily transit back to the workforce in future.

How Can SAHMs Plan For Retirement?

- Find a job which allows you the flexibility of working from home, so that you can earn your own income. You can find resources on flexi-work here.

- Understand how to maximize your tax reliefs here.

- Smartly manage your cost of living, such as preschool fees and grocery.

- Next, develop a savings goal e.g. I want to save $20,000 in the next 5 years. Read our “How to Invest and Grow Your Money Series“, and “Financial Planning For Your Family“.

- Teach your kids money management skills as their spending habits will also impact your retirement fund.

See also: Your retirement plan: 5 questions to start asking

By Jules of Singapore.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: