Dear Gurus,

I understand that children get hospitalised often when they are young. I’m thinking if I should get hospitalisation insurance plans for them, since I have the option to extend my company group insurance to my family.

Angeline, 28

Guru Foo:

Angeline, it is wise of you to know that the probability of children getting hospitalised in their younger days is higher. It’s just like how I will advise my clients: “Which will you rather pay? Insurance premium or hospital bills?”

It is wise of you to opt for your company group insurance extended to your family as you can enjoy coverage at a group rate. Do find out if your company hospitalisation insurance is portable. If it is non-portable, it means that you and your family will not able to enjoy the coverage once you leave your company and by then, some of you and your family may have experienced changes in your health and will become not insurable.

If it is non-portable, do consider taking up some form of individual insurance coverage.

Guru Ed:

As Guru Foo has mentioned, having a portable insurance is more important than an affordable insurance, because if it is not portable, it only gives you a sense of false security that you are protected. But once you are not the employee of the company, all your coverage is lost.

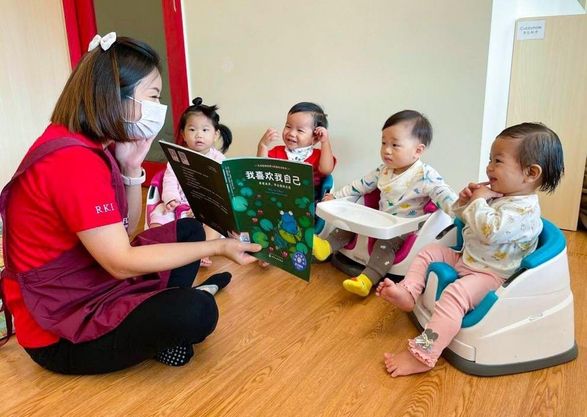

Since the liberalisation of our Medisave account in Singapore, many insurers are providing child hospitalisation insurance plans at an affordable premium payable via Medisave. One of the insurers even provides free coverage till the child turns 20. All the insurers have the option to add a rider payable by cash if you feel that the basic plan is insufficient. It is important that you have a comprehensive and portable medical plan that you truly own.

About the Authors

Guru Ed, has achieved both BSc(Hon) Computing & Information System and Diploma in Banking & Finance.

He is a strong believer in living a balance lifestyle. Other than spending quality time with his 3 lovely children, playing basketball and participating in mini marathon is something that he enjoys. He had 6 years of finance industry related experience.

Guru Foo, has a BSc in Accounting & Finance. Previously, working as a Priority Banker in a leading off-shore bank He is passionate about educating the public about personal finance. Currently, he is in the process of completing his Certified Financial Planner (CFPTM). He is an animal lover and avid runner who participates in Singapore Standard Chartered run yearly. He currently runs his Wealth Management Practice.

You can read about him on his blog: YourMoneyGuru.livejournal.com. You can contact him at kevin_foo@hotmail.com

If you find this article useful, do click Like and Share at the bottom of the post, thank you.

Want to be heard and seen by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: