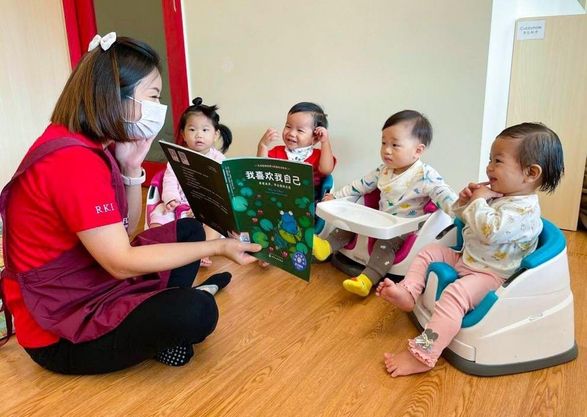

In today’s world, money is digitized and can be spent with a click. Think of the many kids who use cashcards to pay for virtual pets or special weapons for their avatars in online games, or desiring a new gadget because the classmate has one too. The young ones may not relate the items to the price; after all, no actual money is seen. Money is used and exchanged every day, directly or indirectly through goods. It is thus important to introduce the concept of wealth to kids from a young age – when they are able to count and not put coins into their mouths.

- Communicate the values with regards to money

Share what is money and where the money comes from. Explain your values to your children in daily life, such as how to save money and use money. If your child fancies some expensive toy, instead of saying “We can’t afford it”, author Alisa Weinstein recommends saying “We don’t choose to spend our money in that way”. This indicates there are decisions in money management and that we have a choice. One doesn’t purchase something just because one can afford it.

- Talk about savings, spending and purchasing decisions

Talk about what it means to save and spend. If they are old enough, they can also be taught about bank interest, withdrawals and how saving benefits in the long run. When making purchases, simple lessons can be taught by considering the item together. Explain about checking for value, quality, warranty and offer. Is the item needed? When is a good time to buy? Should it be bought at another place? Would another comparative item be of a better purchase?

⇒ Related Read: Simple Hands-On Activities To Teach Children About Money

- Understand that money is not related to love

Parents can help children see that there are many important things that are not money-related -love, family, quality time together. Have you ever caught yourself saying “Now Jayden, be a good boy and I will get you the toy later…”? Christine M. Field (author and speaker) explains that this is a dangerous dance with materialism and if used too often may have negative consequences. For one, a smart kid can use this to his/her advantage by acting out to excise some deal from the parent. Buying obedience with incentives goes beyond increasing materialism in children; it also erodes the idea of unconditional love for the child.

- Differentiate needs and wants

Parents can model for the children the distinction between needs and wants. Needs have priority while wants can be deferred indefinitely. This will cultivate the concept of prioritisation as well as delayed gratification. Avoid loaning or advancing money for the purchase of an item where the child can pay you back later. This is similar to buying on credit and should be discouraged.

- Teach about commercialism

Children are targeted consumers from a young age. They spend their own money as well as their parents’ money. It is necessary to teach them how to discern commercials. Simple ways include educating them on how commercials work, the techniques employed and the claims they make. Discuss with them if a specific commercial’s claims are reasonable and whether their view on the commercial changes after reading the fine print. This will encourage discernment of pros and cons before coming to a decision.

- Teach about giving

Expand the young one’s worldview by teaching about giving to others. Explain social causes that are in the media and where money given goes. This introduces the idea that money is not just for personal use and can be channeled to bigger causes. Being other-focused may nurture contentment and a better appreciation of things that the child has.

Equipping the young ones with the proper concept of money and its value will help them to understand the value behind possessions (not just whether mummy will buy it for me) and be empowered to make decisions on buying and spending. A well-prepared child will be more financially savvy and financially responsible for bigger decisions as he or she grows. Our children need to learn how to handle money, or it will handle them.

By Som Yew Ya.

This article was first published in The New Age Parents e-magazine.

* * * * *

Like what you see here? Get parenting tips and stories straight to your inbox! Join our mailing list here.

Want to be heard 👂 and seen 👀 by over 100,000 parents in Singapore? We can help! Leave your contact here and we’ll be in touch.

Leave a Comment: